Tag: payments

Comprehensive solution needed to support loss-making enterprises

The Ministry of Finance has proposed to develop a resolution to exempt late tax payment penalties for loss-making enterprises in 2022, but enterprises said a more comprehensive solution is needed to support them to earn profits and revenue, and gain orders to overcome the current difficult period.

Vietnam remains an attractive retail market: reports

Vietnam remains an attractive market for retailers as local consumers remain optimistic about the economic challenges and are driving premium purchases.

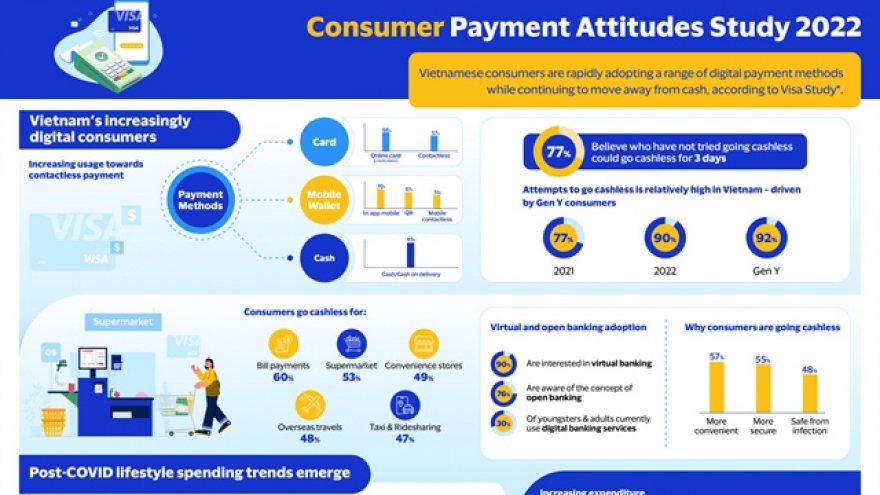

More Vietnamese consumers go cashless: study

Some 77% of Vietnamese consumers believe they could go cashless for three days, according to a new survey by Visa entitled “Consumer Payment Attitudes Study 2022”.

Central bank demands stronger promotion of cashless payment

The State Bank of Vietnam (SBV) has requested banks, branches of foreign banks, and providers of intermediary payment services to take steps to continue promoting cashless payment and the implementation of the national digital transformation programme.

Measures suggested to guarantee corporate bond market’s stability

Several measures have been suggested at an online seminar held by the Government Portal on May 28 to help the corporate bond market maintain its stability and operate in line with law to aid economic growth.

Numerous Cashless Day 2023 events announced

VOV.VN - The State Bank of Vietnam (SBV) and Tuoi Tre (Youth) newspaper held a press conference on May 26 in Ho Chi Minh City announcing the fourth edition of Cashless Day 2023, an initiative aimed at promoting non-cash payments in Vietnam.

Central bank continues to reduce policy interest rates

The State Bank of Vietnam (SBV) has announced two decisions to further reduce policy interest rates, which will become effective from May 25, 2023.

Banking sector invests big in digital transformation

Vietnam's banking sector has invested over VND15,000 trillion in digital transformation by the end of 2022, according to the State Bank of Vietnam (SBV).

MoMo offers installment payment for Apple Store Online purchases in Vietnam

Vietnamese digital payment firm MoMo on May 18 announced that it now provides customers of Apple Store Online in Vietnam with flexible payment options with the launch of monthly installments.

Hanoi to host banking sector’s digital transformation day

VOV.VN - The digital transformation day of the banking sector is set to be held on May 18, the State Bank of Vietnam (SBV) announced at a press conference held on May 11 in Hanoi.

.jpg)