Tag: credit

SBV Governor stresses prudent governance in terms of real estate credit

Governor of the State Bank of Vietnam (SBV) Nguyen Thi Hong has underscored that credit governance must be prudent to help curb inflation and stabilise the macro-economy when responding to legislators’ concern about credit for real estate.

MoIT works with central bank to support petroleum enterprises

The Ministry of Industry and Trade (MoIT) will coordinate with the State Bank of Vietnam to remove difficulties for petroleum enterprises in accessing credit guarantee funds in a bid to prevent disruption in the domestic market.

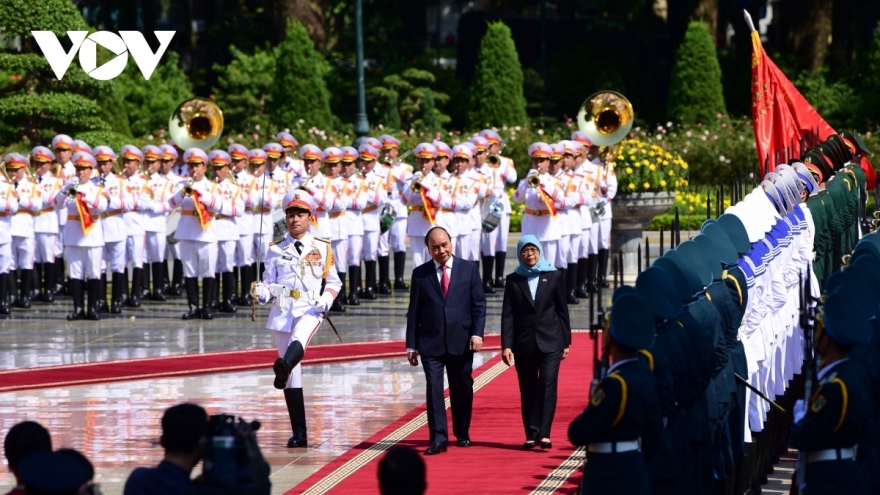

Singaporean media gives positive assessment on President Yacob’s Vietnam visit

VOV.VN - Singaporean media outlets have widely covered the State visit to Vietnam of Singapore President Halimah Yacob which is running from October 16 to October 20, with plenty of positive assessments.

Symposium seeks to foster Vietnam-RoK cooperation in digital banking

The Republic of Korea’s digital transformation policy and implications for Vietnam, Vietnam’s digital banking transformation policy, the importance of credit information system in digital transformation and the leap towards digitisation were discussed at a recent symposium in Hanoi.

Credit growth stands at nearly 10.5% as of mid-Sept

As of September 16, credit grew 10.47% against the end of 2021 and 17.19% against the same period last year, according to Deputy Governor of the State Bank of Vietnam (SBV) Dao Minh Tu.

SBV adjusts credit growth targets for banks

The State Bank of Vietnam (SBV) has announced adjustments to credit growth targets for banks in 2022.

IMF optimistic about Vietnam's economic growth

The first half of this year saw a swift economic rebound as Vietnam’s pandemic restrictions eased following the adoption of a living-with-COVID strategy and a robust vaccination drive, according to an article published on the website of the International Monetary Fund (IMF), imf.org.

Monetary stance points to only mildly higher interest rates in VN: Fitch Ratings

Capital account restrictions largely insulate interest rates in Vietnam from global monetary tightening and the country’s policy rate is expected to increase 50 basis points to 4.5% by end-2023, according to Fitch Ratings.

Agribank hosts Asia-Pacific agricultural credit forum

The Vietnam Bank for Agriculture and Rural Development (Agribank) hosted the Regional Policy Forum of the Asia-Pacific Rural and Agricultural Credit Association (APRACA) on July 20 in Hanoi.

Banks upbeat about Q3 2022 business results

A majority of credit institutions (CIs) are optimistic about their business performance in Q3 2022, the State Bank of Vietnam (SBV)’s latest survey on business trends of credit institutions showed.