Tag: credit

Banks offer higher deposit rates after credit growth quota expanded

Many banks have increased their interest rates to attract more depositors after getting a credit growth quota expansion from the State Bank of Vietnam (SBV).

Vinfast obtains US$20.5-million tax credit for operation in California

The California Governor's Office of Business and Economic Development (GO-Biz) has granted VinFast US$20.5 million worth of tax credit, the Vietnamese automobile manufacturer said on November 5.

Finance ministry works on corporate bond market development

The Ministry of Finance is taking measures to better develop the corporate bond market safely and effectively.

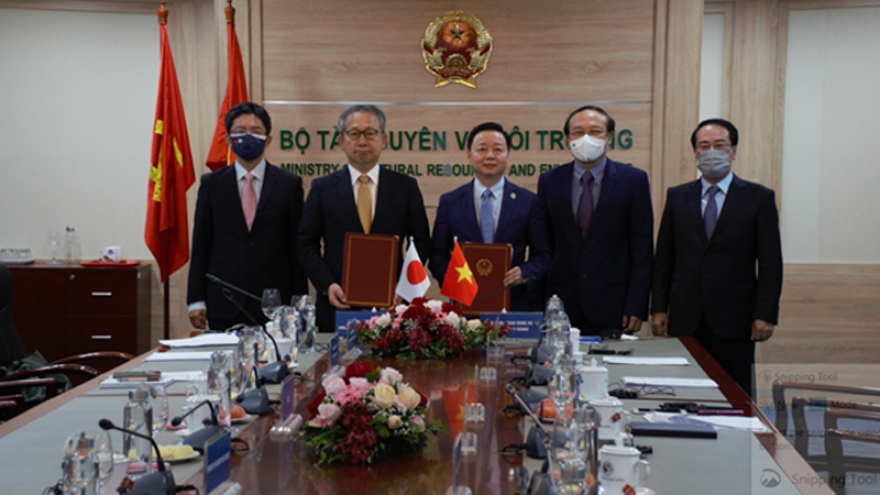

Vietnam, Japan sign MoU on low-carbon growth

Vietnam and Japan signed a Memorandum of Understanding (MoU) on Joint Credit Mechanism - JCM at a ceremony held in both virtual and in-person forms on October 14.

StanChart forecasts rate cut if COVID-19 impact lasts beyond Oct

Standard Chartered has forecast a potential interest rate cut if the economic impact of Vietnam’s COVID-19 outbreak lasts beyond October.

PetroVietnam’s State budget payment surpasses 2021 target

The Vietnam Oil and Gas Group (PetroVietnam) has surpassed important business and financial targets set for the first nine months of 2021, with its contribution to the State budget fulfiling the yearly plan.

Banks’ profits forecast to decline by 19% in Q3

Profits of the banking industry in the third quarter of 2021 would decrease by 19% compared to the previous quarter due to slowing credit growth and increasing provision expenses, Yuanta Securities Vietnam estimated.

Vinpearl successfully issues exchangeable sustainable bond

Vinpearl, a major hospitality-recreation developer and operator in Vietnam, has successfully issued a US$425 million Exchangeable Sustainable Bond (ESB), exchangeable into shares of its parent company Vingroup.

Banks continue bond issuance to meet capital adequacy ratio

Banks have been promoting the mobilisation of medium- and long-term capital through bond issuance to meet the State Bank of Vietnam (SBV)’s requirements on capital adequacy ratio (CAR).

Fitch Ratings ranks PetroVietnam's Standalone Credit Profile at 'BB+'

Fitch Ratings has assessed the Vietnam Oil and Gas Group (PetroVietnam)'s Standalone Credit Profile (SCP) at 'BB+', reflecting the company's conservative financial profile, diversification and integration.