Tag: bond

Buybacks of pre-maturity corporate bonds increase by 5.8% in 2023

Vietnam's corporate bonds worth VND230.2 trillion (nearly US$9.5 billion) had been redeemed before maturity by December 25, an increase of 5.8% compared to the figure in 2022, according to the Ministry of Finance.

State budget collection up 4.5% in 2023

The total revenue to the State budget as of December 25 surpassed VND1.69 quadrillion (nearly US$69.5 billion), up 4.5% compared to the yearly estimate, heard a conference hosted by the Ministry of Finance in Hanoi on December 27.

Corporate bond market recovering well in second half of 2023

The corporate bond market is "warming up" and recovering thanks to effective support policies, according to insiders.

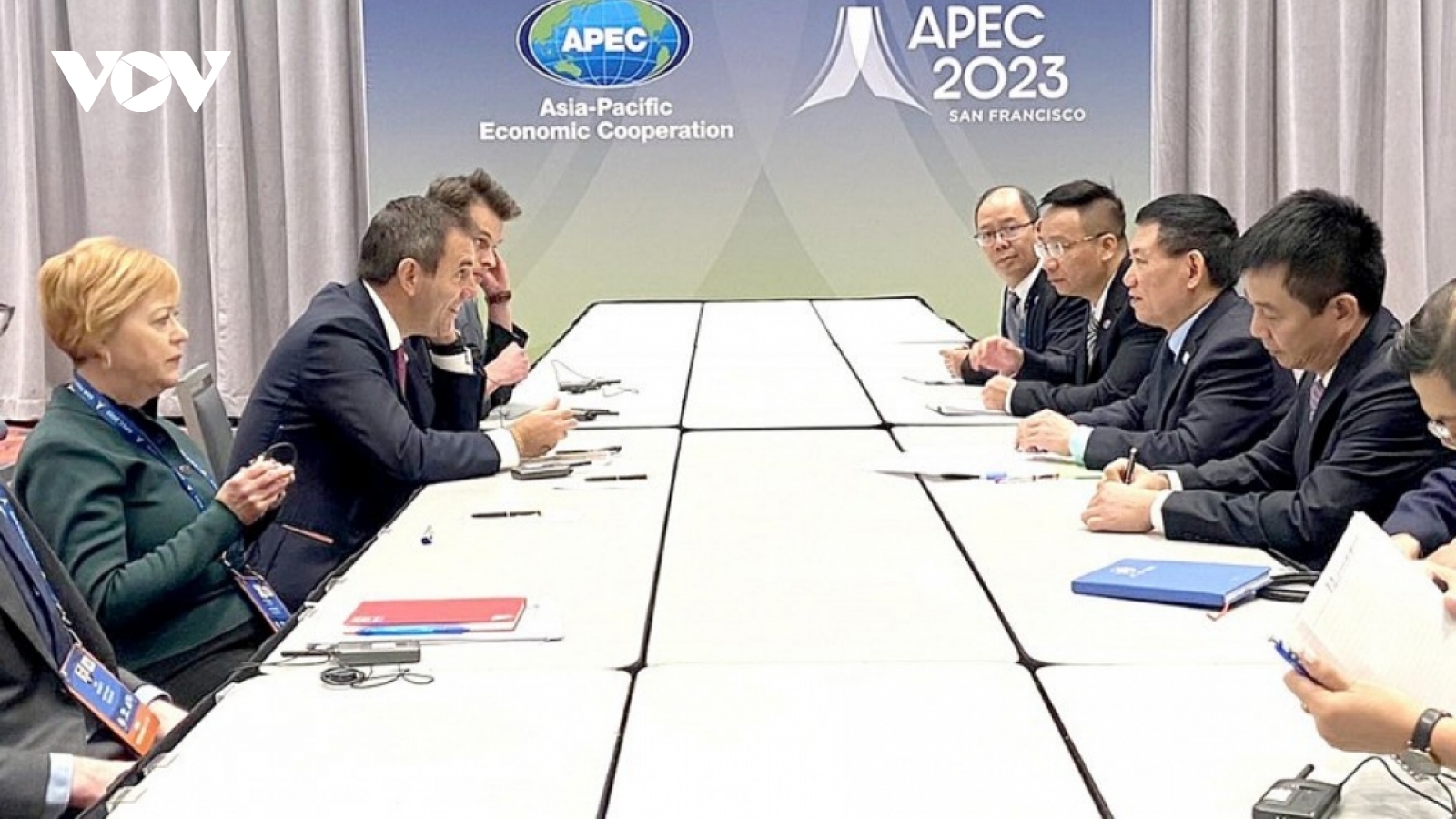

Vietnam boosts finance cooperation with Australia, Japan, Singapore

VOV.VN - Minister of Finance Ho Duc Phoc expressed Vietnam’s desires to enhance finance cooperation with Australia, Japan and Singapore during his separate meetings with financial leaders of the three countries on the sidelines of the APEC Finance Ministers’ Meeting 2023 in San Francisco, USA, on November 12.

State budget revenue down 8.3% in nine months

The State budget revenue was estimated at over VND1,223 trillion (US$50.8 billion) in the first nine months of this year, or 75.5% of the estimate, marking an annual decrease of 8.3%, according to the Ministry of Finance.

Top Party leader affirms special bond between Vietnam and Laos

VOV.VN - Vietnam attaches great importance to promoting the great friendship, special solidarity and comprehensive cooperation with Laos, Party General Secretary Nguyen Phu Trong told outgoing Ambassador Sengphet Houngboungnuang at a reception in Hanoi on September 20.

Vietnam, Laos and Cambodia vow to forge close bond amid global changes

VOV.VN - Vietnam, Laos and Cambodia have pledged to stay united and strengthen cooperation to overcome challenges and boost development in their respective countries amidst regional and global complications.

Vingroup raises funds from bond issuance for VinFast factory in Hai Phong

VOV.VN - Vingroup, the largest private economic conglomerate in Vietnam, is going to issue bonds to mobilise VND10 trillion for its affiliate VinFast’s car manufacturing plant in Hai Phong.

New firms up 0.2% in seven months

The number of new firms established in the January-July period, at 89,600, was up 0.2% from the same period last year, but their total registered capital reduced by 17.1% to VND834 trillion (US$35.2 billion), reported the General Statistics Office.

Over US$1.8 bln pour into corporate bonds in H1

The total value of corporate bond issuances was recorded at VND42.783 trillion (US$1.86 billion) in the first half, according to data compiled by the Vietnam Bond Market Association (VBMA) from the Hanoi Stock Exchange (HNX) and the State Securities Commission (SSC).