Tag: Agribank

Central bank moves to sell SJC gold bars at ‘stable prices’

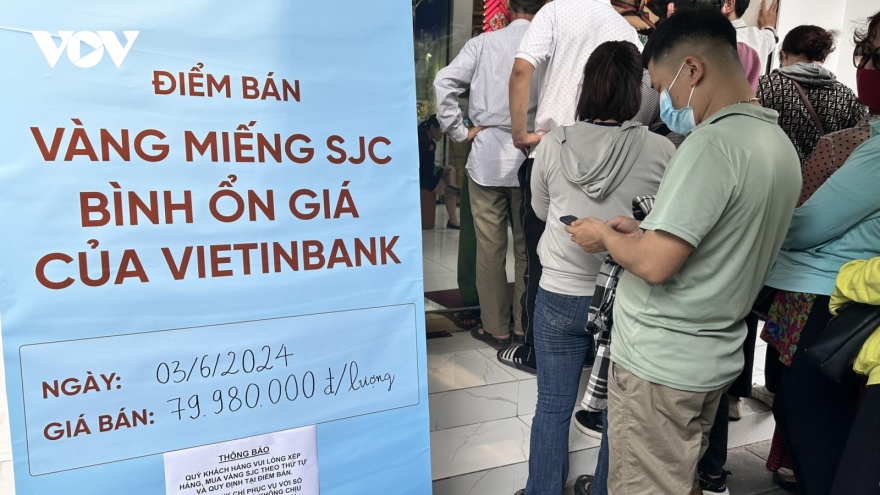

VOV.VN - The State Bank of Vietnam (SBV) on June 3 sold SJC branded gold bars to four State commercial banks and a gold and gemstones company at a stable price in an effort to narrow the disparity between domestic and global gold bar prices.

Major banks continue to reduce deposit interest rates

Deposit interest rates at four major banks of Vietnam have been adjusted sharply, down by 0.2-0.4% per year from the previous listings, bringing the rate to 2.2% per year at the lowest.

‘Big Four’ slash deposit interest rates to lowest in banking system

The four biggest banks in Vietnam have strongly cut interest rates for various deposit terms to the lowest levels of the year.

Big 4 banks launch preferential interest rate loan packages

The group of the four biggest State-owned banks (Big 4) have launched preferential loan packages with interest rate reductions of up to 3% per year to lower short-term lending rates to only 7% per year.

Agriseco anticipates rising Chinese FDI inflows to Vietnamese market

VOV.VN - Foreign direct investment (FDI) inflow from China into the nation is expected to increase amid China reopening its doors and resuming flights between the two countries, according to Agribank Securities Company (Agriseco).

Agribank hosts Asia-Pacific agricultural credit forum

The Vietnam Bank for Agriculture and Rural Development (Agribank) hosted the Regional Policy Forum of the Asia-Pacific Rural and Agricultural Credit Association (APRACA) on July 20 in Hanoi.

Agribank ranks highest among Vietnamese banks in Brand Finance Banking 500

The Vietnam Bank for Agriculture and Rural Development (Agribank) climbed 16 spots to 157th in the 2022 Brand Finance Banking 500 ranking, which features the most valuable and strongest banking brands in the world.

Adjusting ownership rate for foreign investors in banking sector is a long-term strategy

As the market is witnessing adjustments in the rate of ownership for foreign investors in banks, analysts say that it depends on the strategy and business plan of each bank from time to time.

Banks cut lending rates to support pandemic-hit clients

The Vietnam Bank for Agriculture and Rural Development (Agribank) on July 15 said it will cut lending rates in Vietnam dong for the fifth time.

Banks lending big to keep agriculture sector ticking

According to the State Bank of Vietnam’s department of credit for economic sectors, as of April credit injected into rural and agricultural development had reached VND2.3 quadrillion (US$100 billion), or 24.6% of the banking sector’s total loans.