Tag: VietinBank

VietinBank announces 2024 cash dividend payment

VOV.VN - The Board of Directors of the Vietnam Joint Stock Commercial Bank for Industry and Trade (VietinBank) has announced the schedule and details for its 2024 cash dividend payment.

Big 4 banks estimate positive business results in 2024

Leaders of the country’s four largest banks (the Big 4 group) BIDV, Vietcombank, VietinBank and Agribank have announced their preliminary positive business results for 2024.

M&A in Vietnamese non-life insurance sector sees strong development

While mergers and acquisitions in the Vietnamese life insurance sector have been relatively quiet, M&As in the non-life insurance sector have been quite strong, with the participation of both foreign and domestic investors.

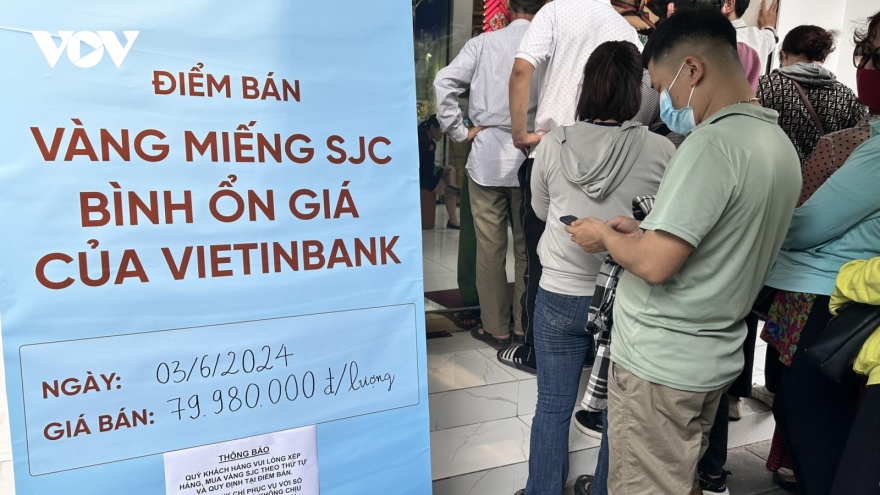

Central bank moves to sell SJC gold bars at ‘stable prices’

VOV.VN - The State Bank of Vietnam (SBV) on June 3 sold SJC branded gold bars to four State commercial banks and a gold and gemstones company at a stable price in an effort to narrow the disparity between domestic and global gold bar prices.

Banks raise interest rates to attract depositors

Many banks have adjusted up savings interest rates by 0.2-0.3% per year since early this months to lure depositors in the context that the savings amount at the banking system has declined for the first time after 25 consecutive month increase.

Major banks continue to reduce deposit interest rates

Deposit interest rates at four major banks of Vietnam have been adjusted sharply, down by 0.2-0.4% per year from the previous listings, bringing the rate to 2.2% per year at the lowest.

‘Big Four’ slash deposit interest rates to lowest in banking system

The four biggest banks in Vietnam have strongly cut interest rates for various deposit terms to the lowest levels of the year.

Five Vietnamese banks named in Forbes Global 2000

VOV.VN - A total of five local banks have been included in this year's Forbes list of the world’s 2,000 largest firms.

VietinBank, MUFG Bank celebrate 10 years of strategic alliance

VOV.VN - VietinBank and MUFG Bank, Ltd. (MUFG) have commemorated 10 years of strategic alliance that enabled both organizations to support the growth of Vietnam’s banking sector and foster deeper Vietnam-Japan business and knowledge exchanges.

Charter capital of banks to increase sharply in 2023

Many banks plan to increase their charter capital in 2023 in order to ensure operational safety and have more resources for business development.