Tag: loans

Vinfast and US Bank partner to provide car rental and loan solutions in US

VOV.VN - As Vietnam’s first global EV maker, VinFast has unveiled that it has selected the US Bank as its priority partner to provide long-term loan and leasing solutions in the United States for customers who rent VinFast’s electric vehicles (EVs) through the US Bank.

Banks requested to cut rates to support economic recovery

Governor of the State Bank of Vietnam (SBV) Nguyen Thi Hong has directed banks to continually reduce input costs with an aim to cut loan interest rates.

Fintech firms step up cooperation with banks to boost lending

Both foreign and domestic fintech firms are promoting connections with commercial banks to lend unsecured loans to individuals, and small and micro enterprises as demand for consumer and business loans at the end of the year is rising.

Low disbursement of public investment sourced from foreign borrowing

The disbursed public investment sourced from foreign borrowing was estimated at more than VND9 trillion in the first 11 months of the year, equivalent to only 26% of the plan, said an official from the Ministry of Finance.

Loosening monetary policy welcomed amid credit crunch

The State Bank of Vietnam (SBV)’s recent decision to revise up the 2022 credit growth target of the banking system has eased access to bank loans amid a credit crunch, especially at the peak season to prepare for Lunar New Year (Tet).

Businesses promote int’l fundraising amid domestic tightened policy

Many Vietnamese businesses have boosted foreign fundraising to cope with their capital shortage amid the country's tightened monetary policy.

DFC loan supports women-owned enterprises through SeABank

VOV.VN - The United States International Development Finance Corporation (DFC) has agreed to grant loan worth US$200 million through Southeast Asia Commercial Joint Stock Bank (SeABank) to support women-owned enterprises in Vietnam.

Government debt repayment on right track: Ministry

Government debt repayments are on the right track, meeting the obligations committed to creditors, according to the Ministry of Finance.

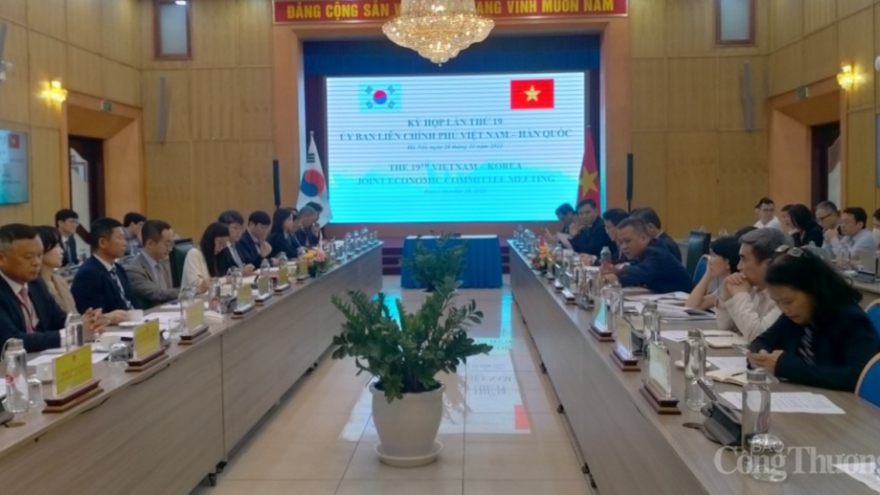

Vietnam, RoK make great strides in multifaceted co-operation

VOV.VN - Recent years has seen co-operative ties between the nation and the Republic of Korea (RoK) enjoy stead growth across various fields, with ties expected to prosper in the time ahead.

Bad debts remain a challenge for banks in Q4 2022

Besides interest and exchange rates, non-performing loans (NPLs) are also a concern for banking activities in the remaining months of 2022, experts have warned.