Tag: debt

Vietnam’s 2023 public debt at 37% of GDP

Vietnam’s public debt in 2023 amounted to VND3.8 quadrillion, equivalent to 37% of gross domestic product (GDP), according to the Ministry of Finance.

Bank bad debts forecast to remain under great pressure in 2024

Though the asset quality of banks in Vietnam will be temporarily under control until the end of 2023, experts said more attention should be paid to the issue in 2024 as bad debts are rising.

Banking system’s bad debt ratio surges to 3.56%

The bad debt ratio of the banking system skyrocketed from 2% at the beginning of this year to 3.56%, or more than VND440 trillion, at the end of July 2023, according to the latest data from the State Bank of Vietnam (SBV).

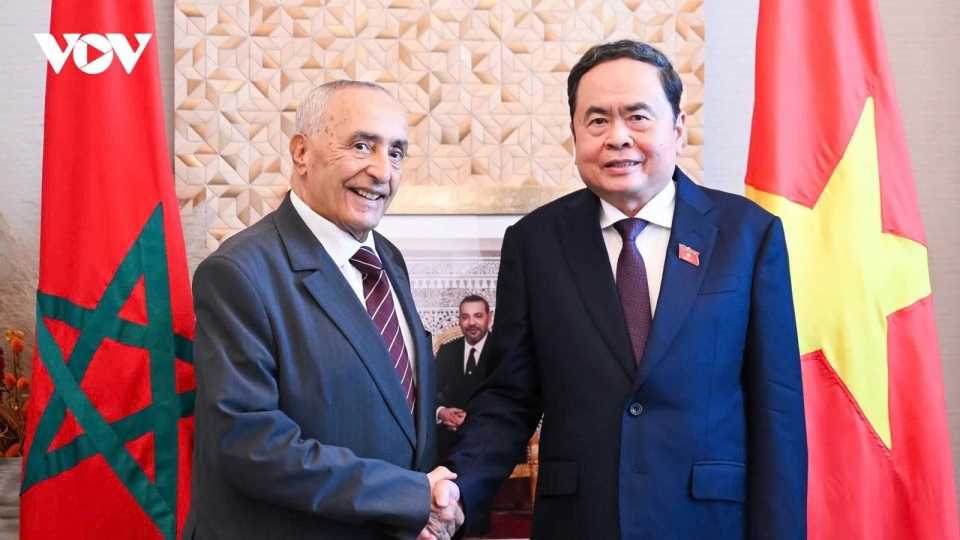

NA Standing Committee’s 27th session opens

The 27th session of the National Assembly (NA) Standing Committee opened on October 11.

Government evaluates socio-economic development at monthly meeting

VOV.VN - Prime Minister Pham Minh Chinh chaired a regular monthly meeting in Hanoi on September 9 to examine implementation of socio-economic development tasks for August and the first eight months of 2023, and put forward solutions for September and beyond.

Financial constraints keep HCM City businesses in tax debts

Financial constraints and liquidity issues are keeping a number of businesses in Ho Chi Minh City, particularly those operating in the real estate sector, in significant tax debts.

Vietnam makes remarkable reforms on public debt management: workshop

International experts shared experience in public debt management and gave recommendations to Vietnam at a consultation workshop in Hanoi on August 17.

Funding, regulatory hurdles challenge Vietnam's developers long term

Property developers in Vietnam face a steep path to long-term growth, with various hurdles awaiting them in the next 12 months, including challenges related to funding access and an evolving regulatory landscape.

Banking sector focuses on credit institution restructuring

The banking sector should take more drastic measures to restructure credit institutions in association with the settlement of bad debts to contribute to curbing inflation and stabilising macro-economic factors, according to insiders.

State budget revenue nears VND770 trillion in five months

State budget collection in the January-May period was estimated at over VND769.6 trillion (US$32.75 billion), equivalent to 47.5% of the estimates for the whole year, the Ministry of Finance reported on June 8.