Tag: VAT reduction

Petrol prices drop nationwide from July 1 due to VAT reduction

VOV.VN - Petrol prices across Vietnam have been reduced following the implementation of a 2% value-added tax (VAT) cut, starting July 1.

National Assembly approves 2% reduction in VAT till year's end

VOV.VN - With 452 out of 453 votes in favor, the National Assembly approved a resolution to reduce the Value-Added Tax (VAT) rate by 2% till the end of the year, at its ongoing session in Hanoi on June 17.

Government proposes 2-pp VAT reduction on select goods and services until 2026

The Government has proposed a 2-percentage-point reduction in the value-added tax (VAT) for goods and services currently taxed at 10%, lowering the rate to 8%.

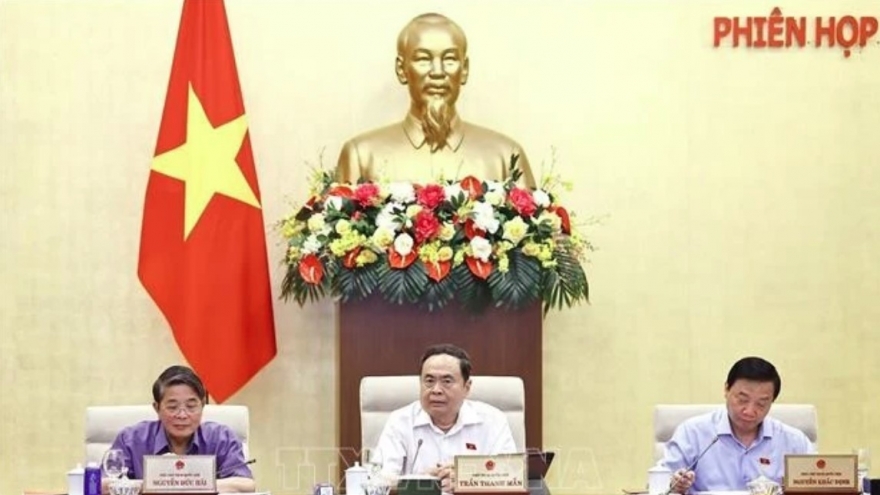

NA Standing Committee discusses continued VAT reduction

The National Assembly (NA) Standing Committee discussed a draft resolution regarding the continued reduction of value-added tax (VAT) for the latter half of 2025 and entire 2026 at its 44th session on April 23.

Constitutional amendments to be debated at NA Standing Committee session

VOV.VN - The Standing Committee of the National Assembly is scheduled to convene its 44th session in Hanoi from April 14 to 28, focusing on law-making, including Constitutional amendments, according to the Office of the National Assembly.

What to know about major economic policies in effect this year

VOV.VN - Several important economic policies are taking effect this year, directly impacting individuals and businesses.

Major economic policies to take effect from 2025

Starting on January 1, significant economic policies will come into effect, including regulations on contract-based passenger transport businesses, a six-month reduction in value-added tax (VAT), amendments to the 2019 Law on Tax Administration.

Key lawmakers support extension of VAT reduction policy till year’s end

VOV.VN - Members of the National Assembly Standing Committee on June 13 agreed with the Government’s proposal to extend the policy of reducing the value added tax (VAT) from 10% to 8% till the end of the year as opposed to the end of June.

VAT reduction of 2% for some goods and services expected to continue

The Ministry of Justice held a meeting to appraise the draft resolution of the National Assembly on VAT reduction, which was chaired by Deputy Minister Tran Tien Dung.

VAT to be reduced by 2% from January 1

The value-added tax (VAT) for most of goods and services will be cut by 2% from January 1, 2024.