Tag: tax

Hanoi gives support to businesses amid pandemic

Enterprises in Hanoi have been receiving support to overcome difficulties caused by the COVID-19 pandemic.

Businesses urged to devise strategy to cope with EU imposition of VAT

VOV.VN - Local firms have been advised to develop a long-term strategy when exporting to the EU market due to value added tax (VAT) being officially applied for online B2C transactions of suppliers from third countries to its customers, according to the Vietnam Trade Office in Belgium and the EU.

E-commerce platforms to be connected with tax agencies from next year

E-commerce platforms must be electronically connected with tax management agencies from the beginning of next year, not from next month, as the tax watchdog aims to better collect taxes from sellers operating on the platforms.

Anti-dumping tax levied on sorbitol products from China, India, Indonesia

The Ministry of Industry and Trade (MoIT) has decided to impose an anti-dumping tax ranging between 39.63-68.5% on sorbitol imports from China, India and Indonesia.

Vietnam to solve bottlenecks to develop its auto industry

Limited market capacity and price differences between domestically produced cars and imported cars are the two biggest bottlenecks for the local auto industry, according to the latest report from the Ministry of Industry and Trade (MoIT).

Electric vehicles to be subject to tax incentives in Vietnam

The Ministry of Trade and Industry (MoIT) has said it is cooperating with the Ministry of Finance to consider the provision of tax incentives to encourage the development and use of electric vehicles in Vietnam.

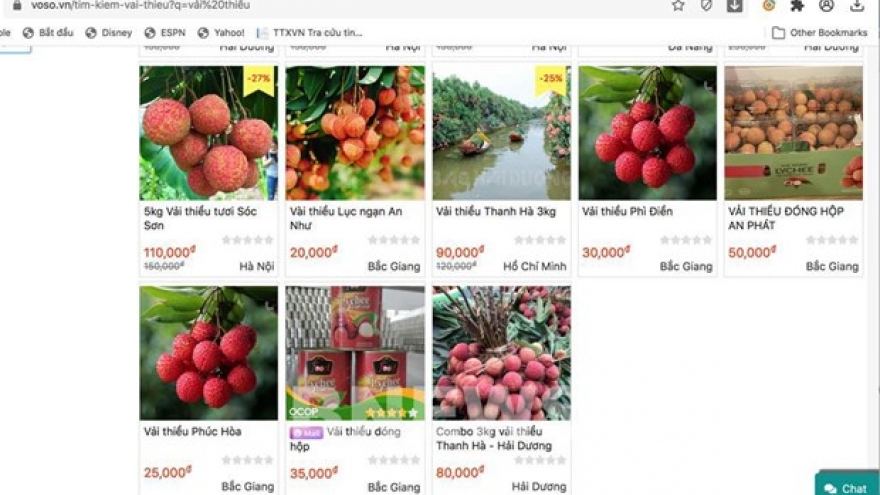

E-commerce platforms to be connected with tax agencies from next year

E-commerce platforms must be electronically connected with tax management agencies from the beginning of next year, not from next month, as the tax watchdog aims to better collect taxes from sellers operating on the platforms.

Online B2C deals to EU to be subject to value added tax from July 1

Online B2C transactions to Europe will be subject to value added tax (VAT) from July 1, the Vietnam Trade Office in Belgium and European Union (EU) has said.

Vietnam imposes anti-dumping and anti-subsidy tax on Thai sugar

VOV.VN - The Ministry of Trade and Industry has moved to levy an anti-dumping duty of 42.99% along with an anti-subsidy tax of 4.65% on some sugar products originating from Thailand.

Vietnam's footwear industry sees robust growth despite COVID-19 pandemic

Despite facing difficulties caused by the COVID-19 pandemic, Vietnam's footwear industry still achieved double-digit growth and some companies have received long-term orders.