Tag: tax

Vietnam to prioritise vaccines, tax exemptions, interest rate cuts

The Ministry of Planning and Investment (MPI) has consulted community businesses to develop the Government's resolution on supporting businesses during the COVID-19 pandemic.

Cash registers at select businesses to connect to tax authorities by 2022

Commercial centres, supermarkets, restaurants, and pharmacies will use electronic invoices generated by cash registers and connected to tax authorities from July 1 next year.

Canada gives final conclusion on anti-dumping duty to upholstered seating from Vietnam

The Canada Border Service Agency (CBSA) has made the final determination on its investigation into the dumping and subsidising of certain upholstered domestic seating from China and Vietnam, according to the Ministry of Industry and Trade’s Trade Remedies Authority of Vietnam (TRAV).

High cost, lack of infrastructure barriers to electric car market

The Ministry of Industry and Trade has just released a list of factors that are undermining the development of the electric car industry in Vietnam.

Ministry proposes 30% decrease in 2021 corporate income tax

The Ministry of Finance (MoF) is proposing a 30% reduction in the corporate income tax which enterprises must pay in 2021 in a draft resolution on budget collection solutions which is to be submitted to the National Assembly’s Standing Committee for approval.

Vietjet's profit reaches over US$5.53 million in first half

The Vietjet Aviation Joint Stock Company (HOSE: VJC) announced consolidated revenue and pre-tax profit of over VND8.38 trillion (US$365 million) and VND127 billion (US$5.53 million), respectively, in the first half of this year.

Over 20 Vietnamese basa fish exporters withdraw from EU market

Nearly 25 Vietnamese companies exporting basa fish have withdrawn from the EU market since the beginning of the year.

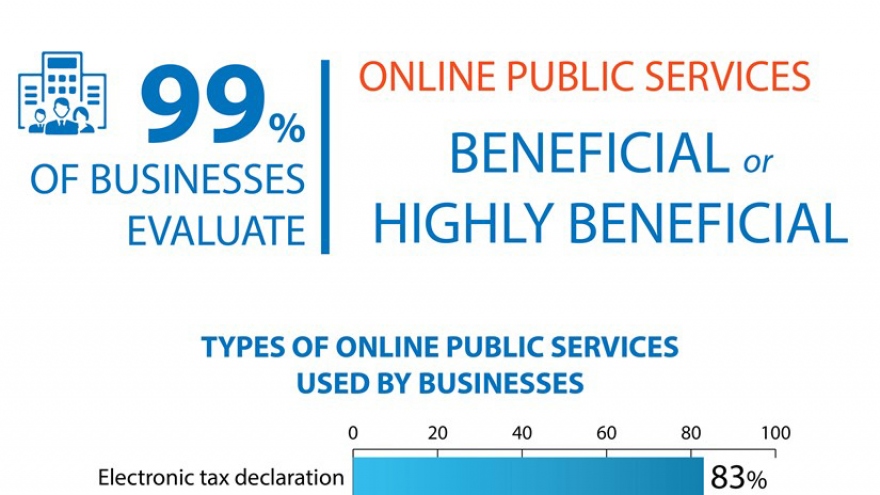

Businesses: Online public services beneficial

Ninety-nine percent of businesses said online public services are beneficial or highly beneficial, according to the E-commerce White Book 2020.

Timeline extended for e-commerce taxation

Vietnam's tax authorities will give five more months for e-commerce platforms to set up data connectivity and begin sharing online sellers' information from January 2022.

Decree amends regulations on cross-border advertising activities in Vietnam

Advertising service providers engaging in cross-border advertising activities in Vietnam must abide by regulations on advertisement, cybersecurity, as well as management, provision and use of Internet services and online information, and must pay tax in line with tax-related laws.