Tag: policies

Manufacturing firms optimistic about Q2 despite mounting challenges: survey

Vietnam's manufacturing and processing enterprises are expressing optimism about business prospects in the second quarter of this year, according to the latest survey conducted by the National Statistics Office (GSO) under the Ministry of Finance.

Vietnamese economy to slow in 2025 before rebounding in 2026: World Bank

VOV.VN - According to the World Bank’s latest report, the Vietnamese economy is expected to experience a slowdown in 2025 but will pick up momentum again in 2026 and beyond.

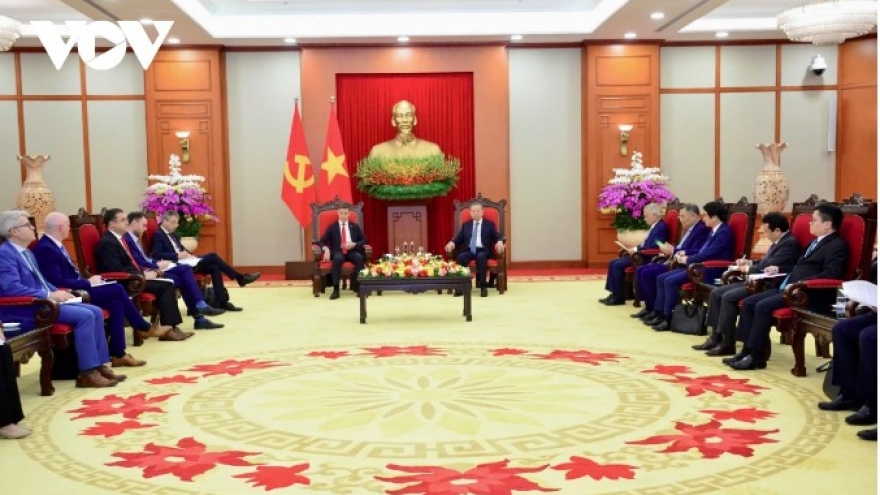

Party chief affirms EU as key partner in Vietnam's foreign policy

VOV.VN - Party General Secretary To Lam has affirmed that the European Union (EU) remains one of Vietnam’s most important partners in its foreign policy during a reception for EU Ambassador Julien Guerrier in Hanoi on April 24.

Policy Dialogue Forum promotes green startups for sustainable development

VOV.VN - On the morning of April 16 in Hanoi, the Ministry of Science and Technology hosted a Policy Dialogue Forum on promoting investment, business, and innovative startups in green transition and sustainable development.

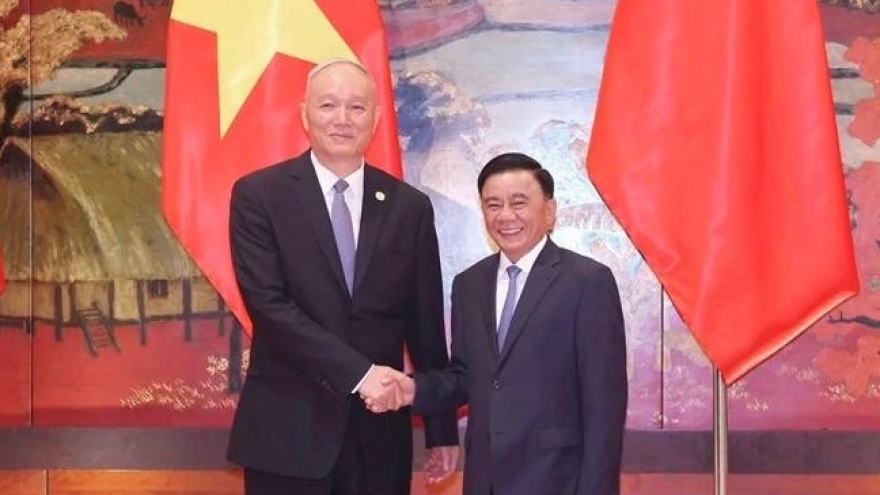

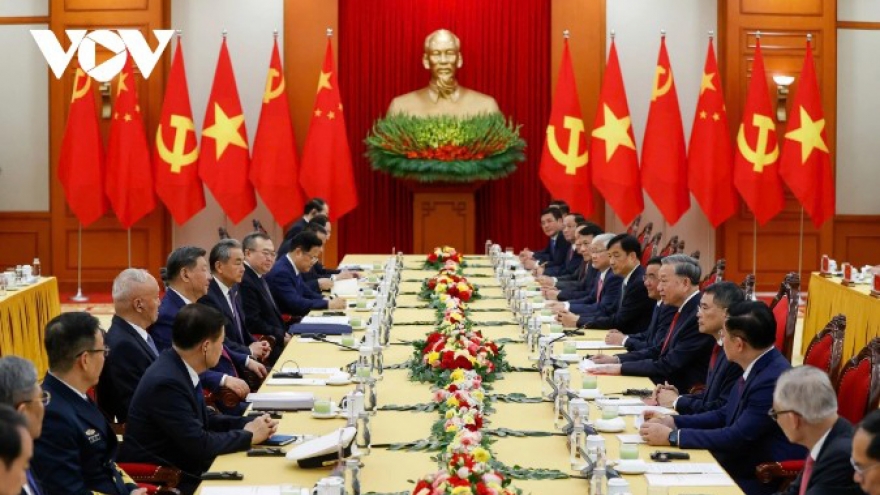

Developing relations with China remains top priority in Vietnam’s foreign policy

Developing a sustainable and long-lasting relationship with China by constantly strengthening political trust and deepening substantive cooperation, is a consistent policy, an objective requirement, a strategic choice, and a top priority in Vietnam’s foreign policy of independence, self-reliance, and multilateralisation and diversification of foreign relations, said Politburo member Tran Cam Tu.

Vietnam consistently regards China as top priority in its foreign policy

VOV.VN - The Party and State of Vietnam always consider developing relations with China an objective necessity, a strategic choice, and a top priority in its overall foreign policy.

More garment cooperation opportunities for Vietnam, India amid global shifts

Vietnam and India have great potential for cooperation in the garment and textile sector as the US's new reciprocal tax policy could significantly impact exports of both countries to the US market, according to Bui Trung Thuong, Trade Counselor at the Vietnam Trade Office in India.

Vietnam and US work on monetary policy management

VOV.VN - Deputy Governor of the State Bank of Vietnam (SBV) Nguyen Ngoc Canh held a bilateral meeting with US Department of the Treasury Deputy Assistant Secretary for Asia and the Pacific Robert Kaproth in Malaysia recently, discussing macroeconomic conditions and current monetary policy management.

Deputy PM urges continued diplomatic efforts to seek appropriate US solutions

VOV.VN - Deputy Prime Minister Bui Thanh Son on April 8 chaired a meeting of the task force on strengthening cooperation and proactively responding to adjustments in US economic and trade policies.

Vietnam welcomes over 6 million foreign tourists in first 3 months

Vietnam's tourism industry continues its impressive post-pandemic recovery, welcoming 6.018 million international visitors in the first quarter of 2025.