Tag: Investors

Domestic funds report impressive growth

The total value of assets under the management of domestic exchange-traded funds (ETFs) has soared by 64% to US$1 billion so far this year, while foreign ETFs increased 12% to US$1.4 billion.

Vietnam becomes bright spot for foreign investors despite COVID-19

VOV.VN - The nation remains an attractive investment destination for investors from the EU, Japan, and the United States and has become the leading priority in the ASEAN region for their medium and long-term goals.

Stock market an attractive investment channel for local players

The stock market is still an attractive investment channel for investors in the near future. However, it also poses many challenges for regulators and market members, said experts.

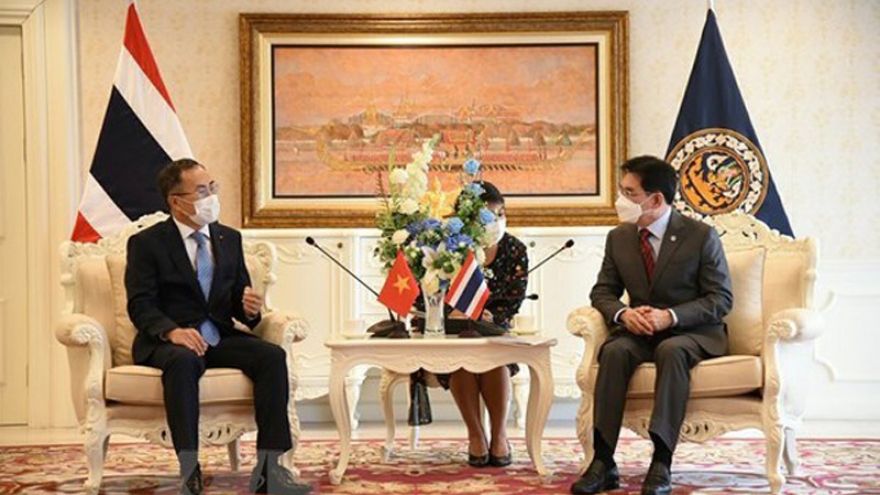

Vietnam-Thailand trade ties flourishing despite COVID-19: Thai Deputy PM

Thai Deputy Prime Minister and Minister of Commerce Jurin Laksanawisit has affirmed that economic, trade and investment cooperation between Thailand and Vietnam is flourishing with bilateral trade in the first four months of 2021 increasing by 20% year-on-year despite the COVID-19 pandemic.

Foreign investors seek PPP guarantees to incite interest

While new public-private partnership ventures and new legislation are in the gun barrel waiting for potential investors to join, possible concerns over risk protection are still in the way, possibly threatening the bankability of the country’s future transport plans.

IPs set up, but Vietnam still needs to do more to attract investors

There were positive developments of industrial parks in Vietnam in the first five months of the year, but experts still say the country should do more to attract big investors.

Vietnam remains attractive among foreign investors despite COVID-19

Vietnam is still a popular investment destination for foreign investors, who poured US$14 billion into the country during the first five months of the year.

HCM City attracts over US$1.34 billion worth of FDI in first five months

The inflow of foreign direct investment (FDI) into Ho Chi Minh City surpassed US$1.34 billion in the first five months of this year, down 16.52% year-on-year, according to the municipal Statistics Office.

IPOs on foreign bourses helping raise prestige of Vietnamese businesses

Conducting an initial public offering (IPO) to list on a foreign stock exchange not only helps Vietnamese companies attract investors but also strengthens their status and the country’s profile in the world.

Vietnamese real estate continues to entice foreign investors

VOV.VN - The level of interest among foreign investors in local real estate projects has continued to see positive changes this year despite numerous difficulties caused by the impact of the COVID-19 pandemic, according to property consultants.