Tag: e commerce tax

Foreign suppliers pay US$328 million in taxes in first nine months

Vietnam’s digital marketplace is paying off, with VND8.73 trillion (about US$328 million) collected from foreign suppliers through the official portal as of September 30, according to the E-Commerce Taxation Sub-Department under the Department of Taxation (GDT).

US extends tax evasion investigation conclusion on Vietnamese stainless steel wires

The US Department of Commerce (DoC) has announced the extension of the deadline for issuing its final conclusion on an anti-dumping tax evasion investigation into stainless steel wires imported from Vietnam, according to the Vietnamese Ministry of Industry and Trade.

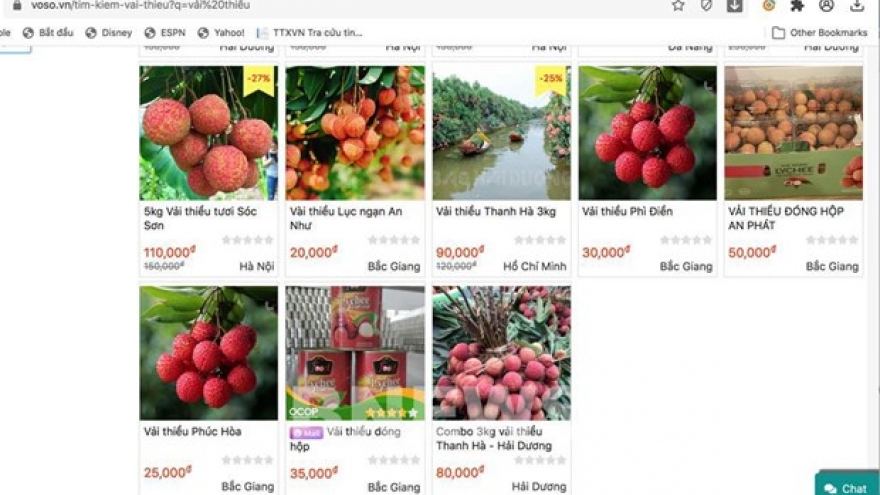

More effective tax collection of e-commerce necessary

Vietnamese e-commerce is growing, creating many opportunities to generate jobs, develop the private sector economy and increase revenue for the State budget. However, preventing tax losses in this business requires improving mechanisms and policies.

E-commerce platforms to be connected with tax agencies from next year

E-commerce platforms must be electronically connected with tax management agencies from the beginning of next year, not from next month, as the tax watchdog aims to better collect taxes from sellers operating on the platforms.

E-commerce platforms to be connected with tax agencies from next year

E-commerce platforms must be electronically connected with tax management agencies from the beginning of next year, not from next month, as the tax watchdog aims to better collect taxes from sellers operating on the platforms.

Collection of tax from online business becomes easier

More and more Vietnamese individuals with businesses online have declared tax and paid personal income tax.

.jpg)