Tag: credit

Credit growth forecast to hit 19-20% this year

VOV.VN - As of the end of September, total credit to the national economy had risen 13.37% compared to the start of the year, marking the highest growth in about 15 years. At this pace, the State Bank of Vietnam (SBV) expects full-year credit growth to reach 19-20%.

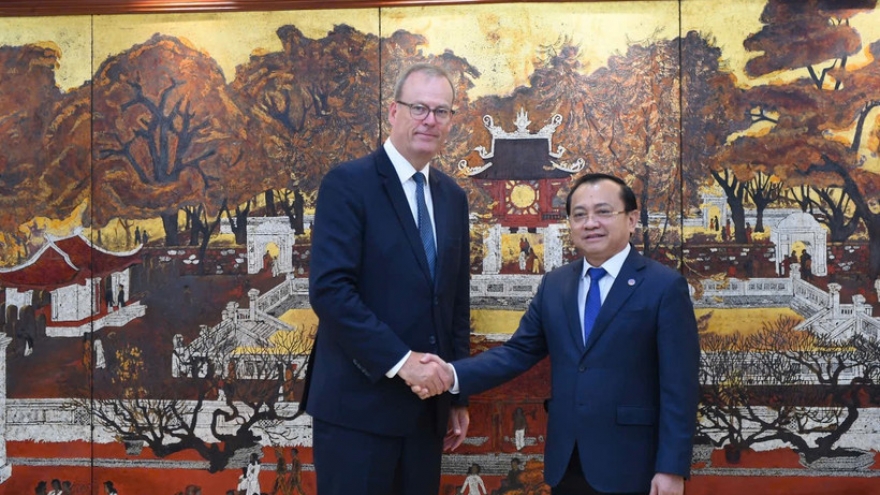

Vietnam, UK deepen cooperation in finance, export credits

Deputy Minister of Finance Le Tan Can had a working session with Chief Executive of UK Export Finance (UKEF) Tim Reid in Hanoi on September 22, discussing collaboration in finance – export credits, a pillar of trade and investment ties between the two countries.

Zalopay expands QR payment feature to six Asian countries

VOV.VN - Vietnamese travelers visiting six Asian countries – China, Singapore, Japan, the Republic of Korea, Malaysia, and Indonesia – can now make payments easily with the Zalopay app, without the need to exchange foreign currency or open an international credit card.

Vietnam to receive additional US$5 million from carbon credit transfer

Vietnam will receive US$5 million between September and October from the additional transfer of 1 million tonnes of CO2 to the World Bank under the Government's recent resolution regarding the transfer of excess greenhouse gas emission reductions from the north-central region for the 2018-2019 period.

Central bank reassures clients after CIC data breach incident

VOV.VN - The State Bank of Vietnam (SBV) on September 12 issued a statement to reassure clients following a data breach at the National Credit Information Centre (CIC).

National credit info centre hacked, personal data at risk

A cybersecurity breach at the National Credit Information Center (CIC) has been confirmed by the Vietnam Cyber Emergency Response Center (VNCERT), with initial investigations pointing to a criminal cyberattack aimed at stealing personal data.

SBV raises 2025 credit growth quota to support economic expansion

The State Bank of Vietnam (SBV) on July 31 announced that it has raised the credit growth target for commercial banks to support economic growth amid controlled inflation, in line with the Government’s directives.

Complete legal framework needed to develop carbon market in Vietnam

VOV.VN - Vietnam is racing to complete a comprehensive legal framework to launch its national carbon market, a key step toward meeting its net-zero commitments and driving a low-carbon, competitive economy.

Vietnam’s credit conditions to remain stable in H2

Vietnam’s credit conditions will remain stable in the second half of 2025, supported by proactive fiscal measures and ongoing institutional reforms, according to analysts of the Vietnam Investors Service (VIS) Rating, an affiliate of Moody’s.

Inflation pressure in H2 driven by exchange rates and credit, expert warns

Despite the average inflation rate for 2025 being forecasted at around 3.4%, it is crucial to closely monitor inflationary pressures stemming from exchange rates and credit growth to draw up effective inflation control policies, said Nguyen Duc Do, deputy director of the Institute of Economics and Finance.