VNS

8047 newsArticles by author

Stars of A Tourist’s Guide to Love reunite in Vietnam

International and local cast and writer of A Tourist’s Guide To Love reunited in HCM City on April 20 to celebrate the film’s release.

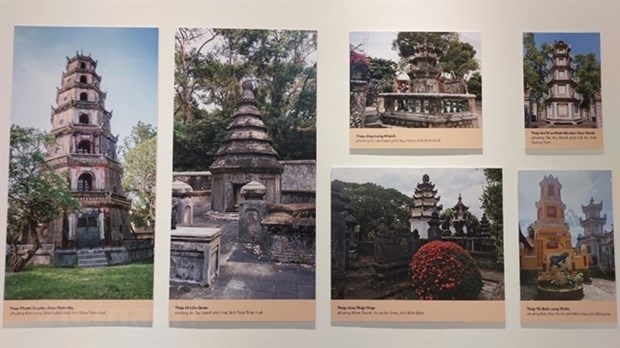

Archives, photos of Vietnamese Buddhist architectures displayed in Hanoi

Nearly 300 archives and photos featuring the most outstanding features of Vietnamese Buddhist architecture are being exhibited at the Vietnam National Museum of History (VNMH), No. 25 Tong Dan street, Hoan Kiem district, Hanoi.

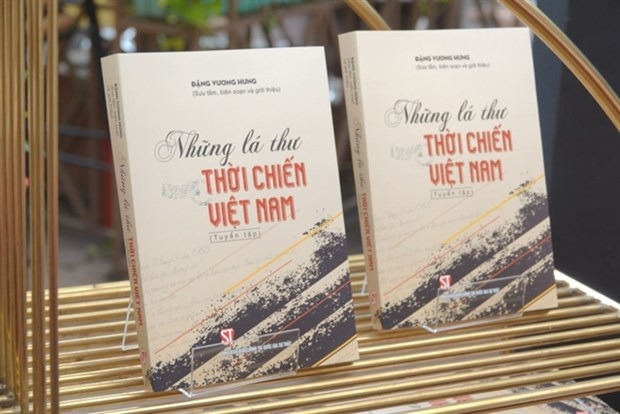

New book collection of wartime letters hits the shelves

The Su That (Truth) National Political Publishing House has launched a special collection of letters showcasing the glorious national history and the love of a young generation during the wartime.

Vietnam Medipharm Expo 2023 returns to capital city

As many as 350 domestic and foreign enterprises will join the 30th Vietnam International Medical and Pharmaceutical Exhibition (Medi-pharm Expo 2023), slated to be held in Hanoi from May 10-13.

Real estate market needs credit solutions: experts

In an effort to address the ongoing challenges faced by the domestic real estate market, an approach encompassing legal, administrative, and financial solutions is urgently required, particularly in the realm of credit.

Vietnam remains hub for tech talent

Vietnam continues to be a hub for strong tech talent, said the Southeast Asia Startup Talent Report 2023.

Hau wins Asia-Pacific Trail Run, qualifies for world championships

Ha Thi Hau met no difficulties in winning the inaugural XTERRA Asia-Pacific Trail Run Championship's 35km race at the picturesque Stony Brook Nature Farm in Kenting, Chinese Taipei, on April 16.

Oanh to run at world championship in August

Nguyen Thi Oanh will represent Vietnam at the World Athletics Championship 2023 taking place from August 19 to 27 in Budapest, Hungary.

Standard Chartered, MISA to provide financing to small businesses

Standard Chartered Bank has announced the launch of a strategic partnership with information technology company MISA JSC to offer unsecured invoice financing to small and medium-sized enterprises at competitive interest rates and straight-through processes.

HCM City business group suggests economic pump-priming measures

The Ho Chi Minh City Union of Business Associations has proposed authorities to resolve difficulties faced by businesses suffering from a sharp drop in export orders.