Tag: SBV

Credit institutions forecast lower pre-tax profit growth in 2026

Credit institutions expect the business outlook to remain positive in 2026 but are more cautious about profit growth, according to the latest survey by the State Bank of Vietnam (SBV).

Deposit interest rate cap forecast to rise by 50 basis points in 2026

Under pressure from the mandated loan-to-deposit ratio (LDR), the State Bank of Vietnam (SBV) might have to raise the deposit interest rate cap by 50 basis points in 2026, analysts say.

Nearly 18 billion cashless transactions recorded in nine months

Nearly 18 billion cashless transactions were recorded in the first nine months of 2025, with total value surpassing VND260 quadrillion (nearly US$10 billion), according to the State Bank of Vietnam (SBV)’s Payment Department.

Credit growth on track for 18-20% in 2025

Credit growth of 18-20% for 2025 appears achievable as banks’ outstanding loans continued to expand over the first nine months.

Digital payments surge, QR code transactions jump over 150%

Digital payments in Vietnam have continued to expand rapidly, with QR code transactions soaring by more than 150% in value, according to a report released by the State Bank of Vietnam (SBV) on October 29.

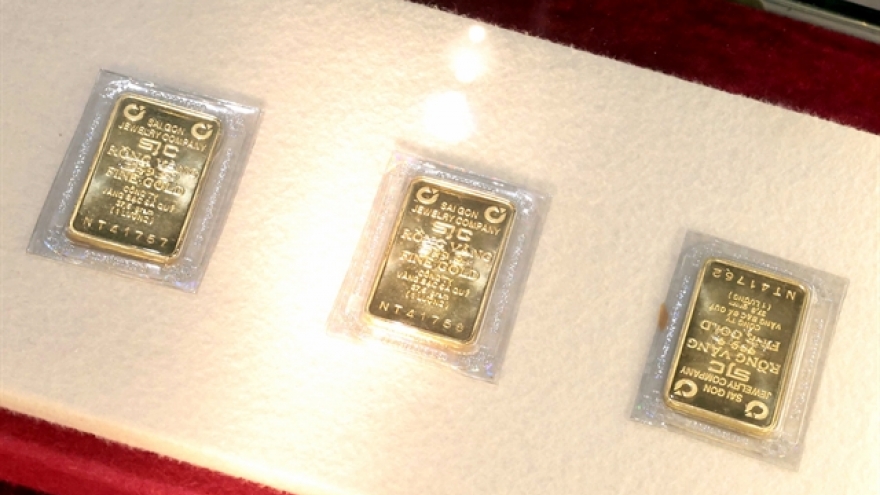

SBV ramps up compliance inspections for gold traders in HCM City, Dong Nai

The State Bank of Vietnam (SBV) has ordered inspections of gold trading enterprises in Ho Chi Minh City and Dong Nai Province to be intensified following recent volatility and record-breaking surges in domestic gold prices.

SBV cleans 154 million accounts, blocks US$56.9 million in suspicious transactions

The State Bank of Vietnam (SBV) announced that it has cleaned up 154 million bank accounts and flagged nearly 300,000 customers for suspected fraud, blocking transactions worth a combined VND1.5 trillion (US$56.9 million).

New rules on big money transfers to take effect on November 1

Domestic electronic transfers worth VND500 million (over US$18,900) or more, and international electronic transfers of US$1,000 (or the equivalent in foreign currency) or above, will have to be reported to the State Bank of Vietnam (SBV).

SBV Governor Nguyen Thi Hong rated A+ by Global Finance

Global Finance has ranked Governor of the State Bank of Vietnam (SBV) Nguyen Thi Hong A+, the highest grade in its 2025 Central Banker Report Cards.

SBV raises 2025 credit growth quota to support economic expansion

The State Bank of Vietnam (SBV) on July 31 announced that it has raised the credit growth target for commercial banks to support economic growth amid controlled inflation, in line with the Government’s directives.