Vietnam sugar industry hopes to regain home market

In the last five years, Vietnam has been heavily relying on foreign sugar supply. But the state’s efforts and international performance are bringing a golden opportunity to Vietnam to regain its home market.

According to Mercantile Exchange of Vietnam (MXV), the sugar price at ICE US on May 30 was US$559.3 per ton, staying in the high-level area after 12 years. There was a 34% jump earlier this year amid weaker supply in leading production countries.

As of the end of May 2023, India, the second largest sugar supplier in the world, was only allowed to export 6 million tons of sugar of the 2022-2023 crop, a sharp fall from a record high of 12 million tons of the previous crop.

Meanwhile, Brazil, the biggest sugar exporter, has terminated the tax exemption program applied to gasoline since March 1 after stopping the import tax exemption program on ethanol on February 2. Though Brazil is the second largest ethanol producer, it still needs to import it to satisfy domestic demand.

The re-imposition of tax on gasoline and ethanol will increase the proportion of sugarcane for biofuel production, thus indirectly leading to a decrease in sugar output, causing worry about the sugar supply shortage around the globe.

According to Pham Quang Anh from MXV, the sugar price is predicted to stay high in the time to come as prevailing news in the market revolves around the concern about short supply.

This is a great opportunity for Vietnam’s sugar industry and domestic sugar companies to regain their position in the home market.

Vietnam is not a big sugar import market, but sugar demand has been increasing gradually in recent years along with the population increase.

The General Statistics Office (GSO) reported that Vietnam’s population in 2010-2020 maintained a growth rate of 1.05%-1.17%. The agency predicted that the population would exceed 100 million people in mid-April 2023, creating conditions for demand for sugar to continue increasing.

Particularly, activities to stimulate tourism demand after the COVID-19 period, which enhanced eatery services, will create more sugar demand.

However, to satisfy demand in recent years, Vietnam has increased imports instead of increasing domestic production. The expenses on sugar imports have been escalating due to the ICE sugar prices.

Analysts say that the sugar price escalation in the world market has helped sugar companies. Son La Sugar reported a record high profit of VND109 billion, up 90% in the third quarter of 2022. High profit has prompted domestic companies to return to develop the domestic market.

In an effort to protect the domestic sugar industry, on June 15, 2021, MOIT released Decision 1578 on applying anti-dumping and anti-subsidy duties on sugar sourced from Thailand. The duty is 47.64%.

On August 1, 2022, MOIT issued Decision No 1514 on measures to prevent evasion of trade remedies for a number of sugar products imported from Cambodia, Indonesia, Laos, Malaysia and Myanmar.

Thanks to relevant agencies’ efforts, the prices of smuggled sugar are 15 percent expensive than domestic product, which helps encourage farmers to develop sugar cane farming and the local sugar industry.

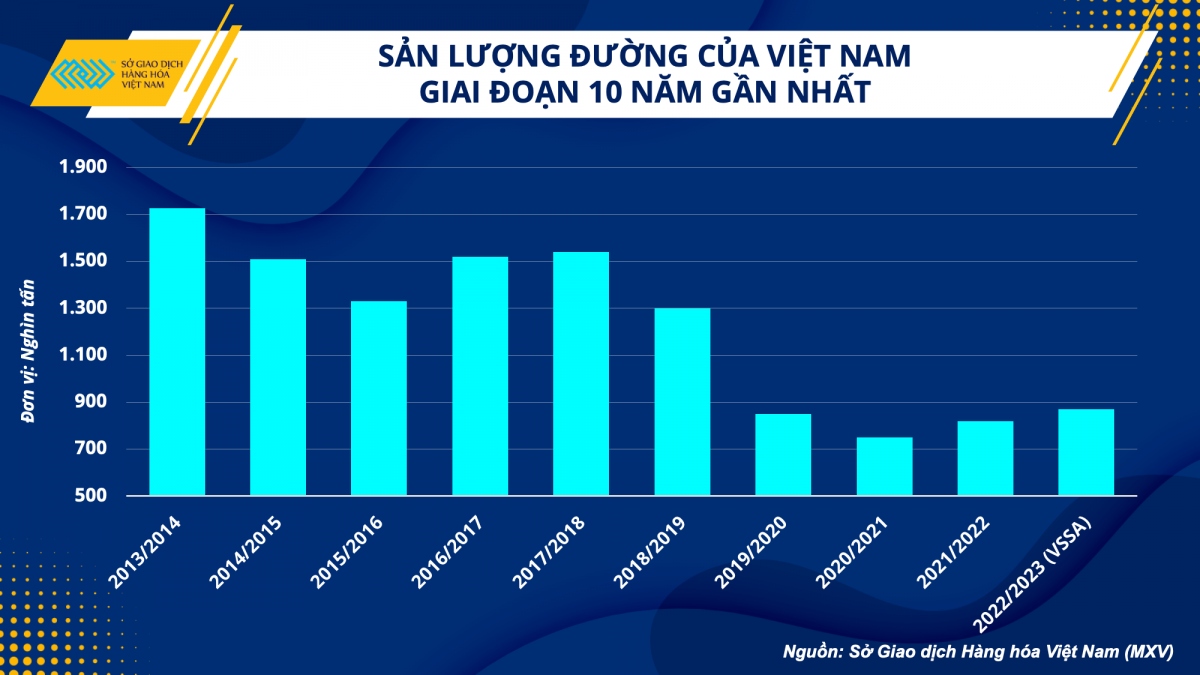

According to the Vietnam Sugarcane and Sugar Association, sugar output of the 2022/23 crop was estimated at 870,930 tons, up 16.6% over the previous crop and 7% over the 2021/22 crop. This is the crop with the second highest output in the latest five crops.

“The harmonization of internal and international factors facilitates Vietnam to recover its sugar industry and control the domestic market. This will help Vietnam prevent unpredictable impacts from the fluctuations in the world market. Vietnamese enterprises and farmers need to timely grasp the opportunities,” Anh said.