Grabbing Grab’s share a tough ask in Vietnam

After Uber Technologies Inc sold its ride and food-delivery businesses in Southeast Asia to bigger regional rival Grab last March, Vietnamese firms have tried to chip away at Grab’s dominance.

|

|

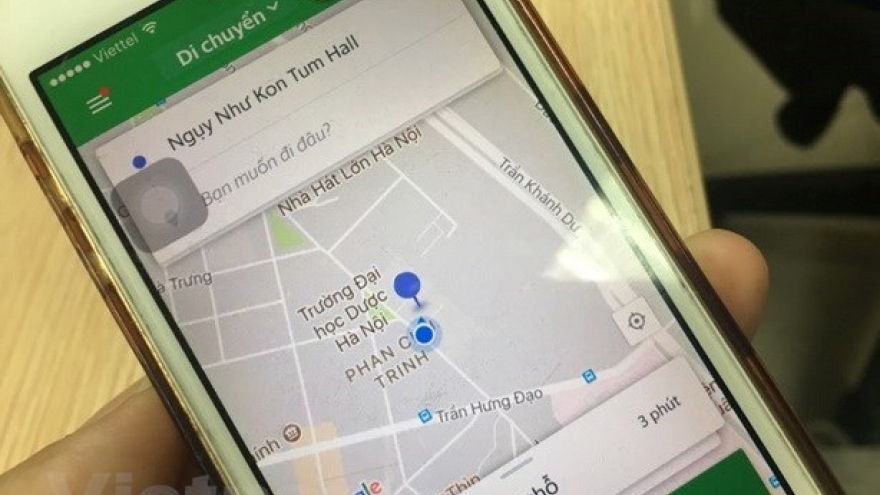

MaiLinhBike is one of the Vietnamese ride-hailing apps hoping to compete with Grab after Uber left the market. Photo by VnExpress/Vien Thong

|

Besides competing in the bike- and car-hailing businesses with dominant player Grab, the new entrants also plan to offer good delivery, car rentals and long-haul ride services.

But, for the moment, none of them have shown the ability to fill the gap left by Uber or to threaten Grab’s supremacy, because they have not differentiated themselves from the competition.

Newcomers did look for some “killer features” that are absent from previous apps to lure customers. For instance, VATO allows users to bargain with the driver for the most competitive price and Mai Linh Bike says it will collect lower commissions from its drivers and will not increase ride prices during peak hours.

But such measures are not enough because ride-hailing is a cash burn business and only those with strong financial resources can endure, experts say.

EasyTaxi has probably learned how tough this fight is. The Brazil-based company came to Vietnam at the end of 2013, six months before Grab and Uber’s presence in this market. Despite being the first comer, it withdrew from the market just two years later. Money, or the lack of it, was the reason, industry insiders say.

Cash burn strategy

Even big players like Grab and Uber have reported heavy losses in Vietnam. According to the General Department of Taxation, Grab, with a total registered capital of only VND20 billion (US$881,057), has incurred losses of nearly VND1 trillion in three years of operating in Vietnam.

But this cash burn strategy is how Grab and Uber are eating up traditional taxi firms’ market share. In 2014-2015, they launched intense promotional programs including free rides and discounts to lure customers. They also expanded their driver networks by providing them with subsidies and big rewards based on performance.

Limited funding limits the budding competitors’ ability to offer incentives the way the big players can, so the former are always playing catch up. They can’t offer discounts, and can’t expand their network of drivers in order to offer faster, better rides.

In a price-driven market, customers are always looking to choose the cheapest possible ride. And they have complained that it is not easy to book a ride with the new apps even in downtown areas.

Duc Huy, a senior student at the Academy of Journalism and Communication in Hanoi, told VnExpress that he found it difficult to get a ride on MaiLinhBike as there are not many drivers around North Tu Liem District where he lives.

“I have to wait for 10 minutes to get on a MaiLinhBike ride because the river is 2-3 km away,” he said.

Drivers too see Vietnamese ride-hailing platforms as backup options. They are not ready to switch despite Grab cutting back on drivers’ incentives.

Taxi driver Duy Ngoc said he operates on both Grab and VATO apps, but gets just two or three rides booked on the VATO platform a day.

“So, I mainly drive on the Grab platform to ensure my income,” he said.

“New apps do not have a large customer base. Drivers just sign up to get incentives, so their main driving service remains the previous one (Grab),” said 25-year-old Grab motorcycle driver Quoc Anh.

Market niches

With Go-Jek about to set foot in Vietnam with its Go Viet app, competition is only get tougher for local firms. The Indonesian ride-hailing firm is a heavyweight competitor to Grab in the Southeast Asian region. Will local apps stand a chance? The answer is, unlikely, in a head-to-head fight.

“Capital shortfall is a disadvantage for Vietnamese ride-hailing apps, so they should not enter the cash burn race,” said Dr Nguyen Duc Thanh, head of the Vietnam Institute for Economic and Policy Research.

He said going head-to-head with bigger rivals is not the right path to follow. There are other ways to succeed, he added.

“They can enter niche markets like good delivery, car rentals or long-distance ride services. Instead of trying to divide market share in the beginning, newcomers should think of a long-term strategy to build a solid foundation,” Thanh added.

It was not a fluke that even a well funded Uber lost to a more localized opponent, he said.