2% VAT cut proposal gets the go-ahead

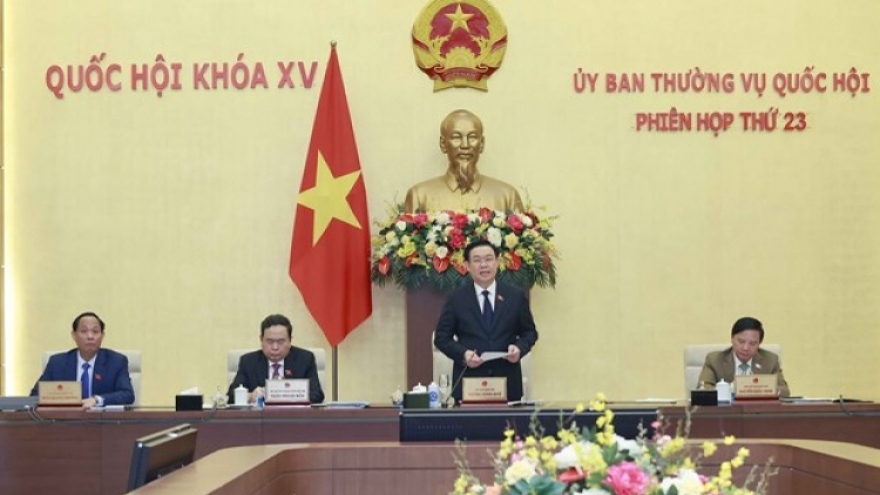

VOV.VN - Lawmakers on June 24 approved a resolution on the reduction of the value added tax (VAT) by 2% within six months in an attempt to reboot the economy and stimulate consumption.

The VAT cut from the current level of 10% to 8% is set to take effect from July 1 to December 31, 2023. It will apply to most provisions of goods and services, except for a number of goods and services belonging to telecommunications, real estate, securities, insurance, and banking.

Other products that do not benefit from the 2% VAT cut policy also include metals, prefabricated metal products, mining products, refined petroleum, chemical products and items subject to excise tax.

In its previous plan, the government had proposed applying the 2% VAT reduction to all provisions of goods and services. However, the National Assembly Standing Committee rejected the plan in a debate, saying such a tax cut would put more pressure on State budget revenue this year amidst economic difficulties and challenges.

The lawmakers then agreed to slash the VAT cut on selected provisions of products and services as prescribed in a similar resolution (Resolution 43) adopted last year by the National Assembly.

According to calculations, the state budget will be reduced by about VND24 trillion if the policy is applied in the last six months of this year.

The new policy is said to assist businesses to overcome difficulties they have faced due to the impact of the COVID-19 pandemic and global market shrinking. It is also expected to boost the economy and stimulate consumption.