2% VAT cut proposal submitted to National Assembly

VOV.VN - Minister of Finance Ho Duc Phoc, on behalf of the government, presented a revised proposal concerning a 2% value added tax to 8% at the ongoing session of the National Assembly in Hanoi on May 24.

Under the original proposal, the Government had expected a 2% VAT cut on all goods and services in the second half of this year to support business production and people’s daily life.

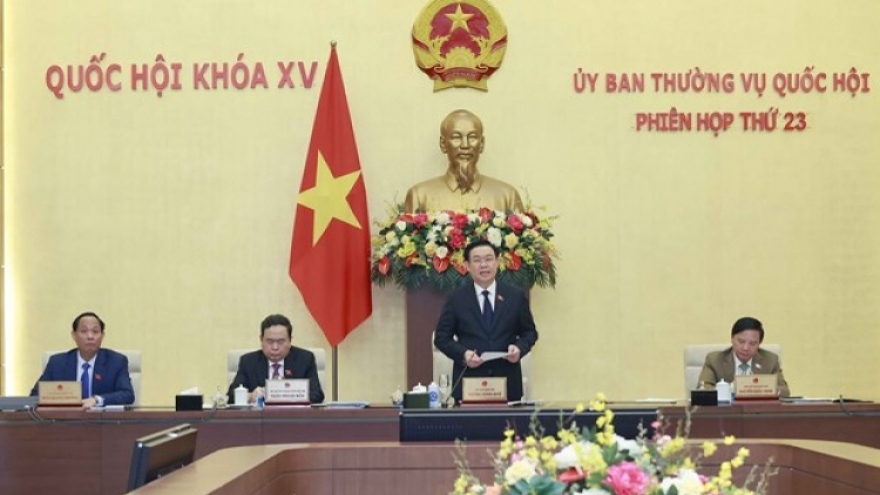

However, the National Assembly Standing Committee, at its recent session, agreed to apply the VAT cut to selected provisions of goods and services similar to National Assembly Resolution 22 passed last year.

The Standing Committee said the expansion of the list of goods and services to benefit from the VAT reduction would put more pressure on State budget collection this year, taking into account difficulties faced by businesses.

According to the government, the state budget would be reduced by about VND35 trillion if the policy is applied in the last six months of this year.

Considering the committee’s recommendations, the Government later proposed that the tax cut not apply to a number of goods and services, including telecommunications, information technology, finance-banking, securities, insurance, real estate, metal products, mining products, refined petroleum products, chemical products and goods subject to excise tax.

Under the revised proposal, the State budget will be reduced by approximately VND24 trillion if the policy is passed by the National Assembly.