VNS/VNA

2513 newsArticles by author

Difficulties in maintaining domestic consumption this year: surveys

Domestic consumption is likely to lose steam as consumers face uncertainties, along with changes to shopping trends. Meanwhile, businesses have reported it's increasingly difficult to maintain purchasing power and reduce inventory buildup, said industry insiders and economists.

Around 8% of Vietnam’s population have accounts for securities trading

Domestic individual investors hold more than 7.98 million accounts for securities trading as of the end of June, or 8% of Vietnam’s population, according to statistics supplied by the Vietnam Securities Depository and Clearing Corporation.

Credit growth soars in June

Credit growth has accelerating since the beginning of June, signaling that the 15% growth target is achievable, if the rate is maintained in the remaining months of this year.

Manufacturing business sentiment to rise

Vietnamese manufacturing business sentiment is set to rise in the third quarter on the back of the country’s unexpectedly higher economic growth in the second quarter and an optimistic outlook for the year.

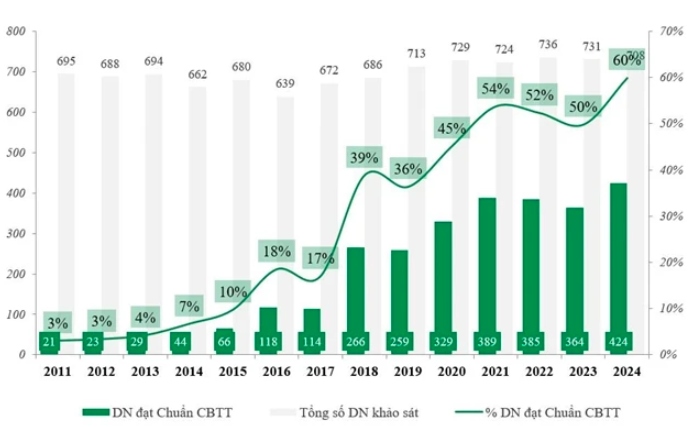

Listed firms’ compliance with disclosure requirements increases sharply

Some 424 out of 708 listed companies on the Hanoi and Ho Chi Minh stock exchanges surveyed have complied with information disclosure norms, 60 more than last year, a survey by the 2024 IR Best Practice Awards programme has found.

Central bank works on protecting banking service users

The State Bank of Vietnam (SBV) will research and amend regulations on safety and security in online banking service provision to better protect customers, an SBV official said on July 4.

Two Vinhomes projects granted permission to sell homes to foreigners

The Department of Construction of Hung Yen province has issued a document to Vinhomes JSC, confirming the approval for foreign organisations and individuals to own residential properties in two Vinhomes projects.

Ancient Buddha statue head unearthed in Thua Thien-Hue

An extraordinary ancient statue relief of a Buddha head is among many artifacts unearthed during the large-scale archeological excavation of Lieu Coc Twin Tower in the central province of Thua Thien-Hue, archeologists have announced.

Vietnamese umpires assigned to work at Wimbledon for first time

Two Vietnamese umpires will work at Wimbledon, beginning on July 1 in London, the UK.

Hospital for wildlife animals operates in the forest

The wildlife rescue station in Dak Lak province has for many years rescued and treated hundreds of wild animals caught in traps or injured.