Steps taken to draw foreign investment in Vietnam’s infrastructure

The Vietnamese government has recently launched the Vietnam Infrastructure Working Group in a move to better lure private investment, especially foreign flow, into the country’s infrastructure development.

|

| Vietnam needs about US$480 billion for infrastructure investment by 2020 |

Despite the huge demand, investment in the sector remains restricted, Dung said, adding that the share of development funding coming from the private sector is less than 10 percent of the national total.

“Therefore, the mobilization of investment source from private sector into infrastructure development is a matter of great concern for the Vietnamese government,” Dung said.

Dung expected the launch of the Vietnam Infrastructure Working Group, which is supported by the World Economic Forum (WEF), will help the Vietnamese government streamline policies, especially for public-private-partnership (PPP) investment model, to attract private capital flows.

"At the moment, Vietnam is going to build the PPP investment law, which will be the most important legal framework to create confidence for both domestic and foreign investors," Dung said.

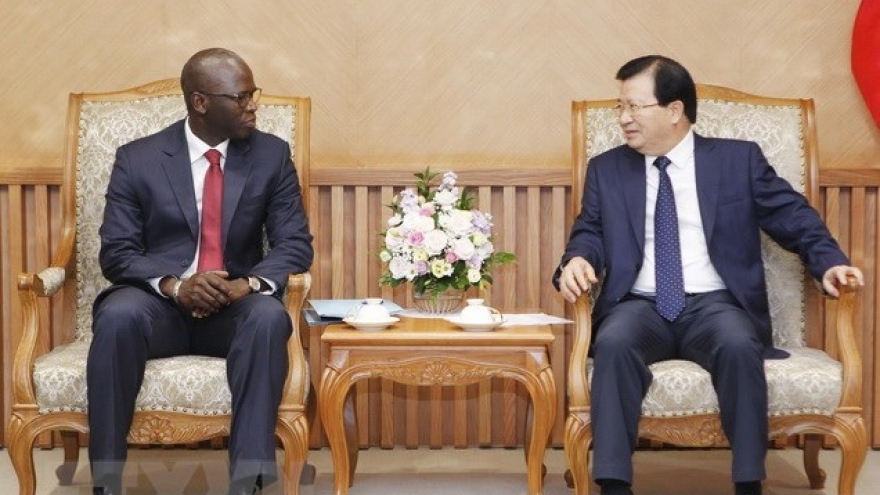

Justin Wood, head of Regional Agenda for Asia Pacific and member of the Executive Committee at the WEF, said infrastructure is the foundation of any economy so it needs to be developed by the cooperation between public and private sectors. What Vietnam must do is to create a common space for both public and private sectors to work together in this field.

He hoped the Vietnam Infrastructure Working Group would act as a facilitator for the government and enterprises to work together, share ideas and make recommendations for more effective and successful public-private partnership.

The WEF will help Vietnam navigate the next phase of growth in the Fourth Industrial Revolution; and one of the seven pillars in the cooperation is to make policy recommendations on future of long-term investment, infrastructure and development, which will be done by the working group, he said.

This year, the working group plans to examine and identify issues on policies to assist the drafting of the PPP investment law while making recommendations in four key areas, including building legal framework for and implementing PPP projects.

Hopeful sign

Vietnam has an ambitious master plan that aims at complete transformation of the nation’s sluggish infrastructural platforms, so as to attract investment and business, promote its industrial hubs and increase its GDP.

The country plans to need about US$480 billion for infrastructure investment by 2020, with additional projects in the pipeline including around eleven power plants with total capacity of 13,200 MW and about 1,380 km of highway; but the State budget can only meet one third of the actual financial needs.

Experts said that the realization of the country's ambitious plan depends on how it sorts out issues of profitability and funding.

According to Vaibhav Saxena, legal consultant at Vietnam International Law Firm, the long-term nature of large scale infrastructure projects, where returns on investment take far longer to realize than those in other sectors, is one of the reasons that make investors hesitate to take the risks involved in them.

However, Saxena said, the establishment of the Vietnam Infrastructure Working Group is expected to encourage leaders, businesses, and scholars to share ideas and initiatives. This is a great opportunity for Vietnam to research and learn from other countries’ experience as well as attract investment for infrastructure development.

“Therefore, more favorable treatment for investors will speed up major infrastructure development projects, in turn making considerable headway in achieving national goals,” Saxena said.