Piloting a crypto asset market in Vietnam - A key step toward the digital economy

VOV.VN - Starting from September 9, 2025, Vietnam pilots its first-ever crypto asset market, a move that signals a major policy shift from observation to building a regulated playing field.

Cryptocurrency and digital asset transactions have been widespread in Vietnam for years, but lacked a legal framework, exposing risks while also leading to tax losses. By launching this five-year pilot scheme, the Government has chosen to manage and supervise rather than impose a ban, creating opportunities to better regulate capital flows, prevent money laundering, and provide a legitimate investment channel for individuals and businesses.

While digital assets carry risks such as speculation, market manipulation, and financial bubbles, the pilot scheme will operate under a “sandbox” mechanism, a cautious approach that allows for experimentation and safeguards financial stability. This step is not only about managing digital assets but also aligns with Vietnam’s broader goals of building a digital economy, fostering innovation, and upgrading its financial market from frontier to emerging status.

Demand for digital assets in Vietnam is already strong. According to Chainalysis, blockchain inflows into Vietnam reached more than US$105 billion during 2023–2024, with nearly US$1.2 billion in profits in 2023 alone. A 2024 report by Triple-A shows that more than 20% of Vietnam’s population owns cryptocurrencies - a rate three to four times higher than the global average. Yet, the State has collected almost no tax from this sector. The pilot programme will enable the government to design a dedicated tax regime, reducing revenue losses and generating new fiscal resources.

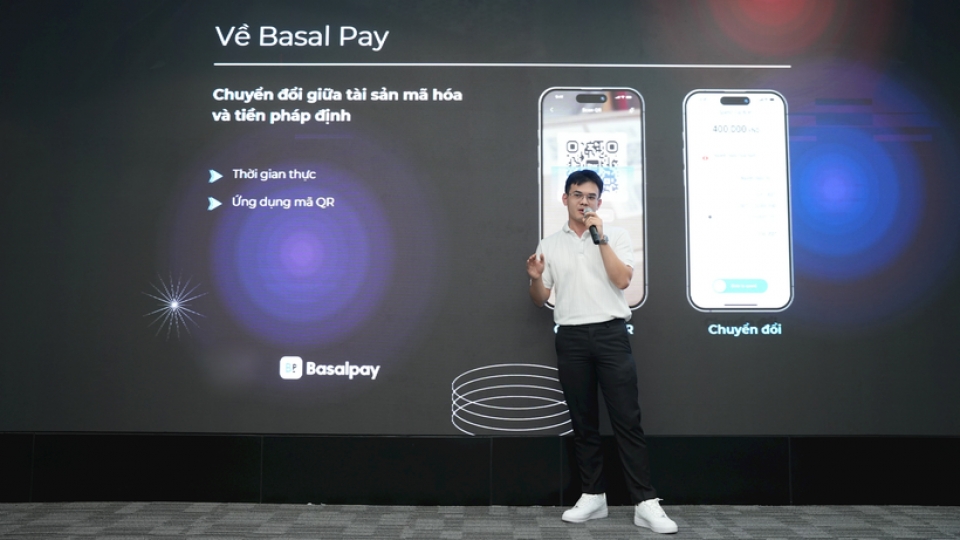

This move is also part of a long-term digital strategy. On January 1, 2026, the Digital Technology Industry Law will take effect, providing for the first time a legal framework for emerging fields such as digital platforms, blockchain, artificial intelligence (AI), and digital assets. In parallel, the National Assembly has approved a resolution on developing an international financial centre, including exchanges for digital assets. The Ministry of Finance has finalised the pilot scheme, with blockchain identified as the core infrastructure for trading and regulatory oversight.

According to To Tran Hoa, deputy director of market development at the State Securities Commission, establishing a legal framework for digital assets is not only an urgent management need but also an opportunity for Vietnam to align with international standards and build a more transparent and stable financial market.

As the global digital asset market approaches US$4 trillion and countries such as Singapore, China, and Japan move forward with national digital currency and stablecoin initiatives, Vietnam’s pilot scheme is seen as a significant catalyst. It promises to boost blockchain adoption, accelerate the digital economy, and bring Vietnam’s financial market closer to global norms.

From an unregulated “gray zone,” Vietnam’s crypto asset market is moving toward a future of clear rules and accountability. This new foundation not only unlocks flows of digital value but also strengthens Vietnam’s long-term goals of building a competitive digital economy and deepening international integration.