New overseas policies ignite fresh FDI wave

The past year marked new movements among the biggest overseas investors in Vietnam, with Japan, the Republic of Korea (RoK) and the United States heading to Southeast Asia with new policies to protect markets, possibly signalling a landmark wave of foreign investment into the country for 2019.

|

Just a few days ago Travelport, a tech company on the New York Stock Exchange providing solutions for the travel and tourism industry, worked with the Vietnamese Ministry of Transport (MoT) on business opportunities for its global distribution system (GDS) in the sector.

“Having a presence in Vietnam for 16 years, Travelport sees huge business potential in not only tourism but also other areas. Thus we are planning to expand operations to other sectors in Vietnam, including in transport,” said Martin Herbert, managing director in Asia for Travelport.

Being one of the world’s leading GDS providers, Travelport’s new move is in line with growing demands for technology applications in the tourism and aviation industries to increase competitiveness in the digital age.

New policies to the south

Travelport’s step is in line with the US government’s recent announcement of the US-ASEAN Smart Cities Partnership, which aims to offer opportunities for US tech companies to develop key urban digital infrastructure in one of the world’s fastest-growing markets.

“This new effort, which includes Danang, Hanoi and Ho Chi Minh City, will seek ways that American companies can help combat growing urban challenges ranging from traffic congestion, water and air quality, to digital security. Our members will be deeply involved in this effort,” said Michael Kelly, chairman of the American Chamber of Commerce in Vietnam (AmCham), which represents the voice of hundreds of US firms in Vietnam.

Market opportunities for digital urban infrastructure and growing demand for digital tools make Southeast Asian cities a promising market for US technology companies. Other American tech giants have, too, been seizing the immense market opportunities that the ASEAN and Vietnam offer. Notably, Amazon has announced that it will partner with the Vietnam E-commerce Association to penetrate Vietnam’s e-commerce marketplace, which is projected to reach a value of US$20 billion in 2020.

Industry insiders said that the US-ASEAN Smart Cities Partnership signals recognition of the importance of Southeast Asia amid the trade war with China.

In absence of US participation in the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), the partnership represents a significant opportunity for the US to bolster its presence and engagement in the region, and will allow the country to participate in setting information and communications technology norms and standards in Southeast Asia, including Vietnam.

In similar moves, Japan and the RoK are promoting their new investment strategies into Vietnam. They are focussed on advanced technologies of Industry 4.0 in alignment with Vietnam’s latest move to prioritise hi-tech and new technologies in its foreign direct investment (FDI) attraction by 2030, to stimulate inclusive socio-economic development.

The RoK is promoting President Moon Jae-in’s New Southern Policy (NSP) in a move to form an axis of prosperity in Asia through linking the northern and southern regions amid the trade stand-off between China and the US.

Under the NSP, Vietnam will be among the business and investment targets in the ASEAN region. The NSP encourages investment in smart/ICT, transport infrastructure, water sources management, and renewable energy in the country.

Thus far, Moon Jae-in’s administration has announced various policy measures to promote investment in these sectors within Vietnam, such as expanding the size of the Global Infrastructure Fund, ASEAN-ROK Cooperation Fund, and Korea-Mekong Cooperation Fund.

South Korean investors in Vietnam have been making moves in line with the new NSP, with outstanding names including Hanwha Aero Engines, Samsung, LG Display, Lotte, and others.

In a way to promote transnational trade co-operation and to ensure the market for Japanese enterprises, the Japan External Trade Organization (JETRO) is piloting 18 projects in the ASEAN, including in Vietnam, focusing on digital technology, healthcare, the Internet of Things (IoT) and services through “the Pilot Project for Nurturing New Industries between ASEAN and Japan”.

According to Tomofumi Abe, director of projects at JETRO, these ventures could potentially be extended to Vietnam because of similarities in manufacturing and society, along with other factors.

“Smart logistics, healthcare, and other services related to manufacturing are indeed not new sectors to Japanese firms. Now they utilise IoT and hi-tech to increase the quality and efficiency of their products,” Abe told VIR.

NTT Data, TBA and Toppan Forms are the prestigious Japanese companies contracted by JETRO to carry out the three pilot projects in smart card use, the time of goods in transit in the ASEAN, and genetic testing kits in Vietnam amid growing local demands in the field.

In particular, NTT Data plans to expand B2B TradeCloud service to ASEAN members’ private companies and customs for the region’s trade facilitation and economic growth, while TBA is planning to work with Vietnamese partner Mebipahr to assemble the mosquito-borne viruses 3 Kit and expand the technology to other application development in Vietnam. Toppan Forms, which already has offices in Vietnam, also has a plan to expand its cashless payment service in the country.

Hitachi High-tech, which piloted a shared smart factory as a service in Thailand, is going to expand to other ASEAN countries, with Vietnam, Myanmar and Cambodia being the primary targets, while Internet Initiative Japan is intending to harness the power of IoT in aquaculture, specifically shrimp in Vietnam.

With these new policies to Southeast Asia, Vietnam is expected to see a new wave of foreign investment in advanced technology of the Fourth Industrial Revolution, especially when landmark free trade agreements (FTAs) take effect.

Experts said that Vietnam already has advantages, and the key issue is how the country solves investors’ concerns to add to its attraction.

Hallmarks in 2018 FDI attraction

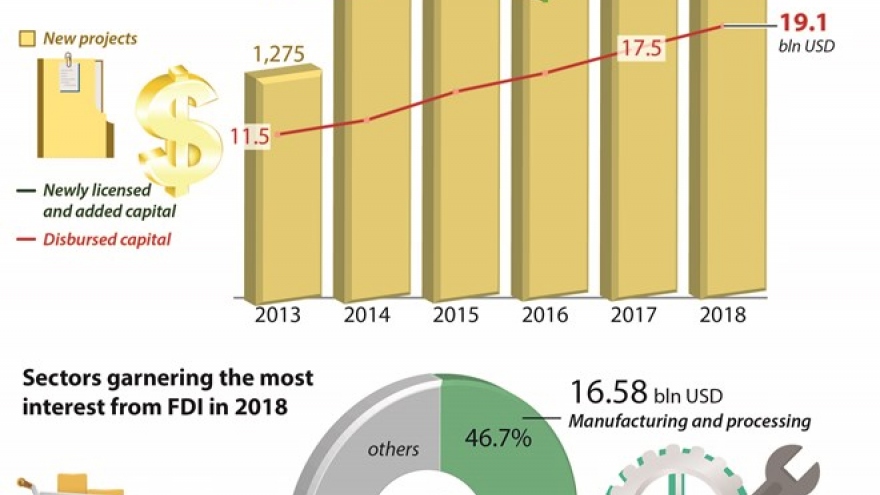

According to statistics from the Ministry of Planning and Investment (MPI), Vietnam attracted nearly US$35.47 billion worth of total newly-registered, added FDI and state acquisitions in 2018, slightly down 1.2% on-year.

Japan, the RoK, Singapore and the US remain the country’s biggest FDI investors, while processing and manufacturing, realty, retail and sci-tech receive the most attention. The cities of Hanoi, Ho Chi Minh City and Haiphong, and Binh Duong province are the most attractive investment locations.

Despite a slight fall, there were some highlights in FDI attraction in 2018. In particular, there is an increase in FDI in sci-tech, reflecting an obvious trend among tech companies. As shown in MPI statistics, sci-tech had the fourth-most attention among foreign investors in 2018, an improvement from ranking 7th in 2017.

In particular, foreign-invested enterprises (FIEs) funded a total of US$2.15 billion in 386 new sci-tech projects in the year to December 20, just behind processing and manufacturing, realty and retail. Of the sum, US$183.37 million is newly-registered capital and US$144.05 million is added capital.

Stake acquisition was the other highlight in the FDI picture in 2018, when it saw a surge of nearly 60% on-year in value and nearly 30% in numbers of transactions.

Remarkably, Vietnam also witnessed improvements in FDI disbursement with US$19.1 billion being disbursed during the 12-month period, up 9.1% on-year, making it a new record. In 2017, FDI disbursement set a record when US$17.5 billion was disbursed, reflecting the improvement in FDI quality.

Business groups in Vietnam, including the chambers of commerce from Europe, the RoK, Japan, and the US, along with the Singapore Business Association, said that their members remain optimistic about business prospects in Vietnam, and that they will continue to make long-term business and investment activities in the country.