Mastercard reaffirms commitment to supporting Vietnam’s cashless future

Mastercard presented an overview of Vietnam’s remarkable transition toward digital payments, while highlighting a series of innovative initiatives that promote more modern, safe, and seamless cashless spending behaviours at the recent '“Cashless Day 2025' conference.

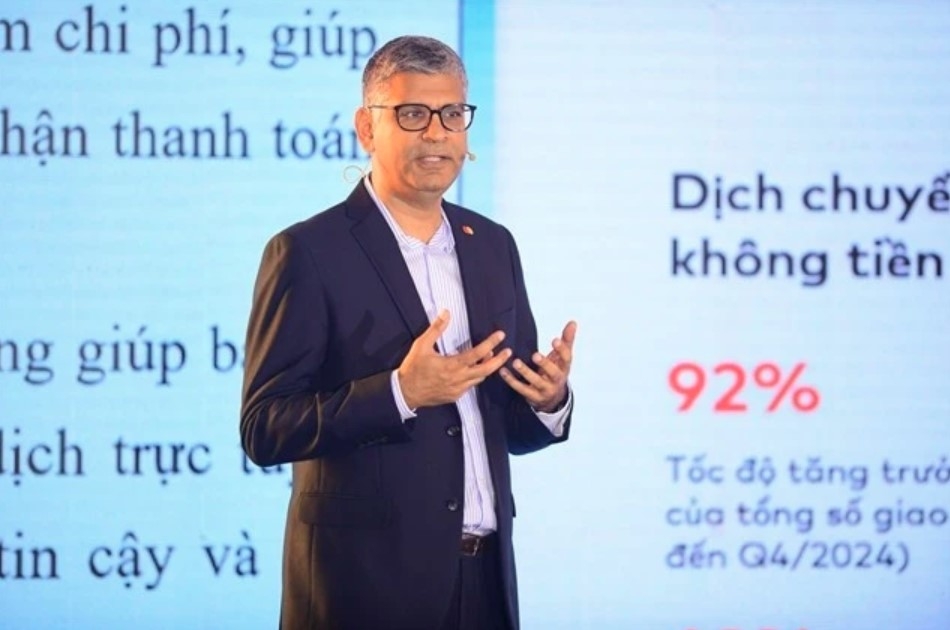

According to Mastercard data, Vietnam has recorded a remarkable 92% compound annual growth rate (CAGR) in contactless transaction volume from Q4 2022 to Q4 2024.

Sapan Shah, Executive Vice President, Acceptance – Asia Pacific, Mastercard, said that this strong momentum is fueled by an increasingly advanced and secure payment ecosystem, driven by technologies such as Tap to Pay and tokenisation, alongside collaboration among banks, fintech firms, and merchants.

Shah also emphasised the pivotal role of the State Bank of Vietnam in leading the digital transformation of the country’s financial system.

During the event, Mastercard introduced three key initiatives launched in the past year:

In partnership with VPBank, Mastercard rolled out the Pay by Account solution, allowing users to make secure digital payments directly from their bank accounts via mobile apps – without the need for a physical card.

Collaborated with HCM City Urban Railways No.1 (HURC1) to integrate contactless payments on Metro Line 1, enabling commuters to simply 'tap and ride' while offering international travellers a seamless way to pay using their global cards.

Partnered with NAPAS and leading banks to launch Vietnam’s first co-badged card, enabling flexible and seamless domestic and international transactions.

Drawing from regional insights, Shah also introduced Mastercard Pay Local – a solution that enables international travelers to use their familiar digital wallets for card-based payments abroad, eliminating the need for cash or currency exchange.

By participating in Cashless Day 2025, Mastercard reaffirms its long-term commitment to partnering with the Government of Vietnam and financial ecosystem to build a sustainable, inclusive, and globally connected cashless future.