Listed firms’ compliance with disclosure requirements increases sharply

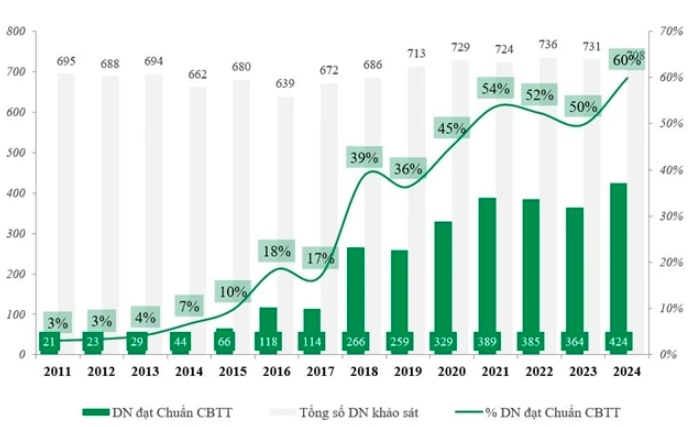

Some 424 out of 708 listed companies on the Hanoi and Ho Chi Minh stock exchanges surveyed have complied with information disclosure norms, 60 more than last year, a survey by the 2024 IR Best Practice Awards programme has found.

The annual survey was done between May last year and April this year by Vietstock, the Vietnam Association of Financial Executives and Finance and Life online magazine.

Disclosure is a mandatory obligation for all listed companies on the country’s two stock exchanges, and responsibility towards their shareholders and the investor community in general.

The ratio of listed companies fulfilling this obligation rose from 50% last year to 60% this year, the highest ever in the 14 years of the programme.

The large cap category had the highest compliance rate at 81% of companies in the financial sector and 65% in others.

Impressively, the compliance rate among small and micro cap companies increased to 58% from 46% last year. It was 60% for mid-cap companies.

In terms of industries, banking led with 18 out of 20 complying, or 90%, a huge jump from previous years, followed by mining (79%), food and beverage (77%) and utilities (76%).

Last year, the securities sector had the highest compliance ratio of 80%, but this year it dropped to 54%.

Construction and real estate had rates just below 50%.

The awards recognise achievements and honour listed companies that meet disclosure standards on the stock market.

After the survey, the programme will move to the evaluation phase of investor relations (IR) activities to nominate the winners of the IR Best Practice Awards.