European SMEs look to rule changes

More European small-and medium-sized enterprises are finding Vietnam a favourable destination for investment in anticipation of the EU-Vietnam Free Trade Agreement and a new law supporting small-and medium-sized firms.

|

The EU-Vietnam Free Trade Agreement (EVFTA) is expected to be ratified and come into force in 2018, while Vietnam’s Law on Supporting Small-and Medium-sized Enterprises (SMEs) was ratified in this June and will become effective from January 1, 2018.

Tran Vu Hanh, a partner DFDL Vietnam law firm, told VIR that Vietnam’s commitments under EVFTA for certain service sector is higher than in other trade pacts.

For example, EU companies can form joint ventures with Vietnamese partners (with foreign equity not exceeding 51%) to provide equipment, rental, and leasing services in Vietnam-as such services are unbound under the country’s World Trade Organization (WTO) commitments.

European companies are also keen on the incentives of the Law on Supporting SMEs in addition to the Law on Enterprises and the Law on Investment.

“Foreign companies will benefit from the new law if they meet the criteria applicable to SMEs in Vietnam, including: having no more than 200 employee contributing social insurance and total capital not exceeding VND100 billion (US$4.4 million) or having no more than 200 employees contributing social insurance and the previous year’s total revenue not exceeding VND300 billion (US$13.2 million). Investors will have to wait, however, for decrees containing governmental guidance on the implementation of the law,” she said.

According to Thomas McClelland, chairman of EuroCham’s Tax and Transfer Pricing Sector Committee, the new measures contained in the Law on Supporting SMEs will make good on the government’s pledge to encourage private firms and create a favourable environment to support startups and innovative enterprises.

The law will benefit both local enterprises-which contribute nearly 50% of Vietnam’s GDP-and foreign-invested SMEs. The reduction in the corporate income tax rate to 17%, simplification of accounting and tax filling procedures, and better access to credit will be a boon to EU-invested SMEs in light of the coming enforcement of EVFTA.

EVFTA is an innovative and ambitious deal, covering a wide range of areas from trade to sustainable development and touching many economic sectors. The foreseeable benefits include tariff removal, lower import costs, trade liberalisation, global value chain expansion, competitive advantages maximisation, and supply diversification.

The agreement is set to bring more business and investment opportunities to companies from both sides, while also establishing innovative investment protection mechanisms.

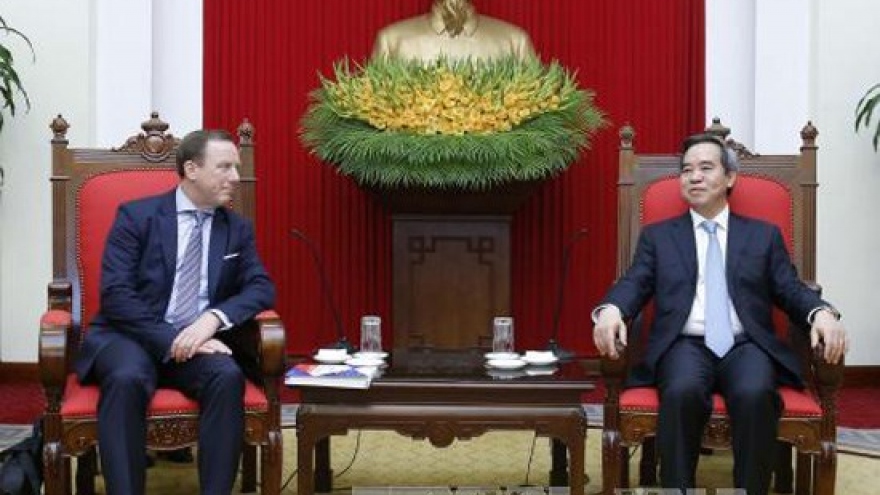

Nicolas Audier, vice chairman of EuroCham, said that EVFTA will be a landmark event in the relations of Europe and Vietnam, and has the potential to foster one of the most dynamic intercontinental trade corridors in the world.

“But EVFTA is not only about trade and investment, it will also bring a new attitude towards business,” he said. “It will create conditions for European knowhow and SMEs to reach Vietnam more easily, with new cutting-edge, smart, and environmentally-friendly solutions and technology. SMEs are the fabric of Europe and Vietnam’s business landscape, and they will benefit from the new environment established by the agreement.”

EuroCham’s Business Climate Index for the first quarter of this year shows that businesses are already anticipating EVFTA. Indeed, firms’ satisfaction scores have jumped to a record level of 86 out of 100. This positive evaluation is thought to be related to the performance of Vietnam as a market, but also to the coming deal.