EuroCham survey shows European business confidence in Vietnam at seven-year high

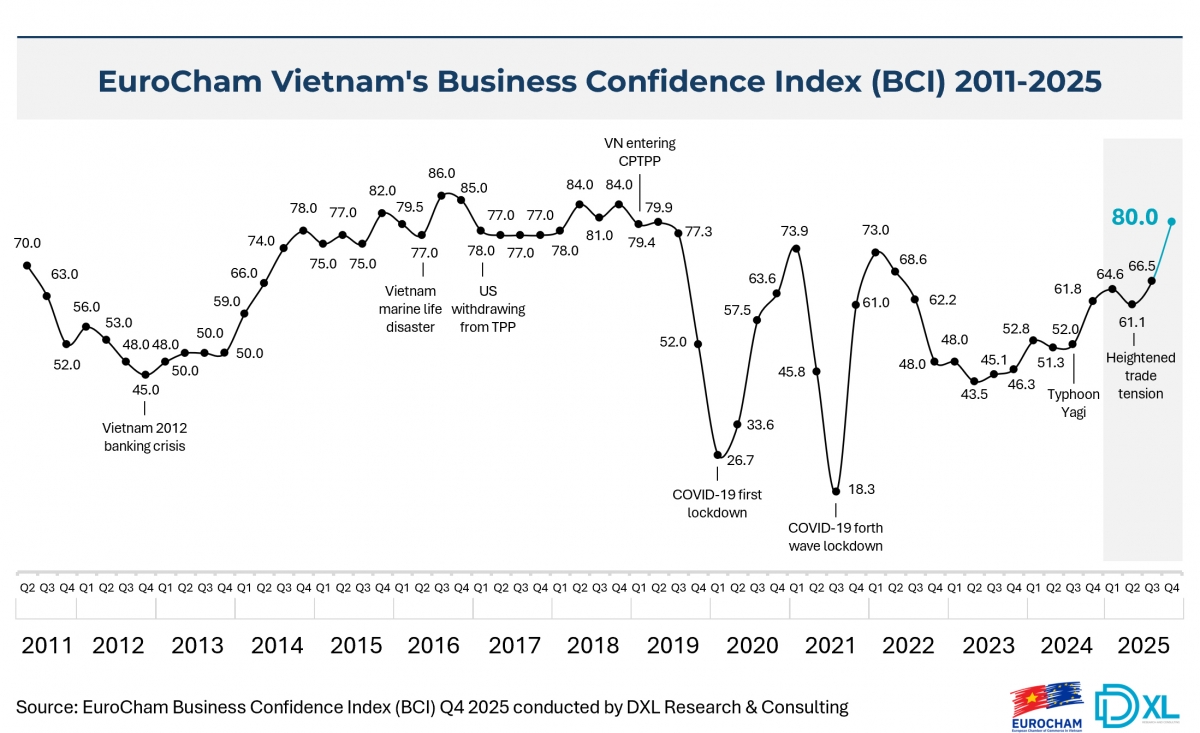

VOV.VN - Business confidence among European companies operating in Vietnam rose to its highest level in seven years in the fourth quarter of 2025, signalling a decisive improvement in sentiment despite ongoing global trade tensions, the European Chamber of Commerce in Vietnam (EuroCham) said.

EuroCham’s Business Confidence Index (BCI) climbed to 80.0 points in Q4 2025, up 13.5 points from the previous quarter, marking one of the strongest quarterly increases since the index was launched in 2011. The reading surpasses levels recorded before the COVID-19 pandemic and prior to the escalation of global trade disputes.

The survey was conducted by DXL Research and Consulting and covers European businesses across sectors and company sizes operating in Vietnam.

Broad-based improvement in sentiment

According to the report, 65% of respondents rated their current business situation as positive, while 69% expressed confidence in their outlook for the first quarter of 2026.

Actual business conditions also exceeded expectations. While only 56% of respondents surveyed in the third quarter expected favourable conditions in Q4, the realised figure rose to 65%, pointing to stronger-than-anticipated performance.

The improvement in sentiment mirrors Vietnam’s macroeconomic performance. Gross domestic product grew 8.46% in the fourth quarter of 2025, the fastest quarterly expansion since 2007 and above forecasts by major international institutions.

“Our latest BCI confirms what many of us have felt intuitively,” said EuroCham Chairman Bruno Jaspaert. “After years of hovering around the mid-line, reaching 80 tells us that confidence is now grounded in delivery – in factories running, orders returning, and investments being executed. We are seeing a structural shift where Vietnam is quickly transforming itself into a powerful growth engine, on track to rank among the top three economies in ASEAN.”

Strong medium-term outlook

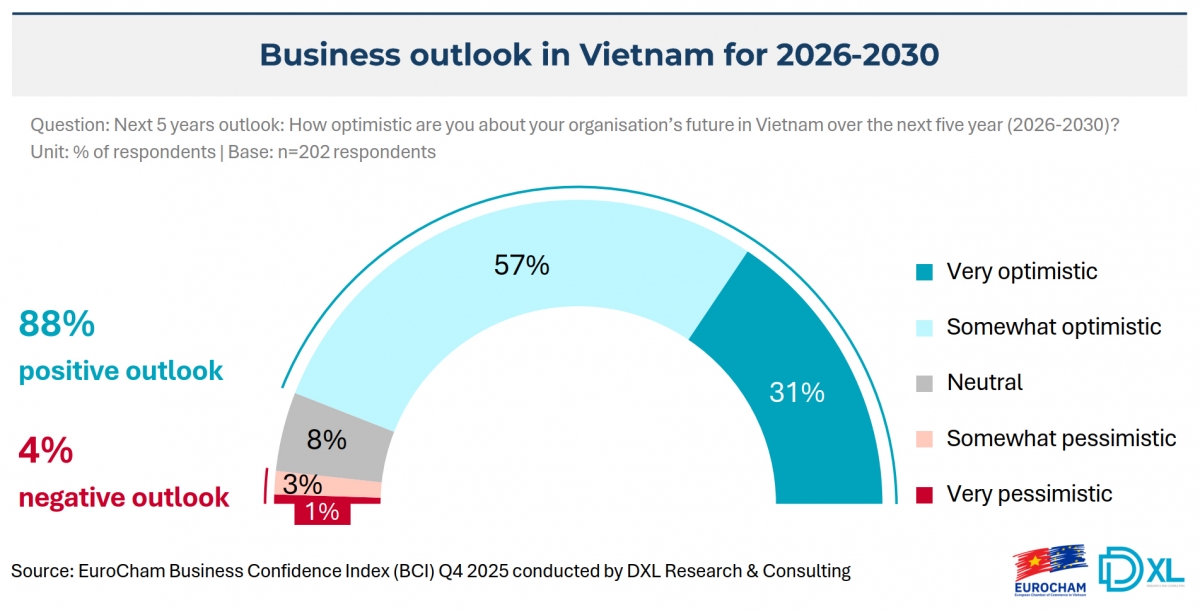

Beyond short-term gains, European businesses are highly optimistic about Vietnam’s medium-term prospects. About 88% of respondents said they were optimistic about their organisation’s outlook in Vietnam for the 2026–2030 period, including 31% who described themselves as very optimistic.

The optimism is supported by recent performance, with 60% of companies reporting improved business results in 2025 compared with 2024, and 82% expecting further improvement in 2026.

Vietnam’s appeal is further reinforced by strong peer endorsement, with 87% of respondents saying they are likely to recommend the country to other foreign investors, particularly among larger companies with established operations.

Global trade tensions remain a risk

Despite the positive outlook, global trade tensions continue to weigh on business operations. In 2025, 42% of respondents reported a net negative impact from global trade tensions, compared with 24% who reported a positive impact and 34% who said they experienced little or no effect.

Smaller firms were more likely to report negative impacts, reflecting their greater exposure to volatility and more limited financial buffers.

“While large multinational corporations are capitalising on their scale to double down on the long term, SMEs are operating without the same buffers against external shocks. Smaller firms are disproportionately exposed to volatility, forcing them to prioritise immediate revenue and survival rather than the broad expansion we see at the top of the market,” said Xavier Depouilly, general manager of DXL Research and Consulting.

Among sources of global tension, US tariff policies and trade disputes were cited most frequently, mentioned by 46% of respondents. The main effects were demand volatility and revenue uncertainty, followed by higher operating costs.

In response, 41% of businesses said they had focused on cost optimisation, while 35% increased the use of technology, automation and artificial intelligence. Some firms diversified operations outside Vietnam or adjusted investment and expansion plans, although 20% reported making no operational changes.

Despite these pressures, 56% of respondents said global developments had made them more optimistic about Vietnam as a place to operate or invest.

Vietnam ended 2025 with full-year GDP growth of 8.02%, underlining what EuroCham described as strong economic fundamentals and resilience.

Administrative challenges ease

Administrative complexity and regulatory inconsistency remain the most frequently cited business challenges, named by 53% of respondents, though this represents a decline of 12 percentage points from the previous quarter.

Other concerns include unclear regulations, customs procedures, trade barriers, and visa and work permit requirements.

Recent reform initiatives, including Resolution 68 on private sector development issued in May 2025, have been welcomed in principle. The resolution aims to reduce bureaucracy, digitalise procedures and shift regulation from pre-approval to post-audit mechanisms.

By the fourth quarter, 25% of respondents said they had seen some improvement in their operating environment, while 61% reported no noticeable impact yet, reflecting the early stage of implementation.

Digital reforms showed similar patterns. While 76% of respondents had completed enterprise registration under the VNeID system, around 24% reported ongoing difficulties, particularly among foreign-invested enterprises.

Outlook for 2026

Looking ahead, European businesses identified public investment and infrastructure development as key growth drivers over the next 12 to 18 months, especially for construction, logistics, trade and consumer-facing sectors.

For 2026, strategic priorities include business development and portfolio diversification, talent recruitment and retention, and greater use of technology, automation and AI to improve productivity and competitiveness.

“Reforms matter most when businesses feel them in their daily operations,” Jaspaert said. “The direction is promising, and what companies are looking for now is consistency, predictability and speed in implementation.”

According to the Eurocharm chairman, in 2026, EuroCham will continue to advocate for the removal of the remaining bottlenecks facing its members and the wider business community in Vietnam.

“Through our Must-Win Battles, we are committed to driving forward regulatory changes that make a difference for both small and medium sized enterprises and multinational companies,” Chairman Jaspaert concluded.