New laws expected to enhance efficiency in national resource management

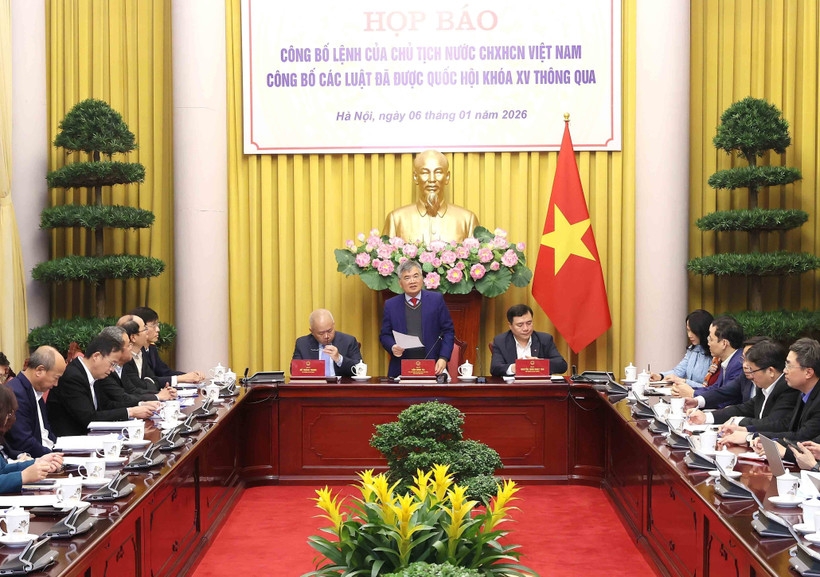

The Presidential Office on January 6 held a press conference to announce the State President’s orders promulgating 12 laws passed at the 10th session of the 15th National Assembly.

The legislation consists of the Law on Personal Income Tax; the Law on Tax Administration; the Law amending and supplementing a number of articles of the Law on Value-Added Tax; the Law on Thrift and Wastefulness Prevention; the Law on Planning; the Law on Investment; the Law on National Reserves; the Law amending and supplementing a number of articles of the Law on Public Debt Management; the Law amending and supplementing a number of articles of the Law on Statistics; the Law amending and supplementing a number of articles of the Law on Prices; the Law on E-commerce; and the Law amending and supplementing a number of articles of the Law on Insurance Business.

Specifically, the Law on Personal Income Tax, comprising four chapters with 29 articles, will take effect on July 1, 2026.

Under the new law, the family circumstance-based deduction for taxpayers is set at VND15.5 million (nearly US$590) per month while the deduction for each dependent is VND6.2 million per month. The Government is authorised to propose adjustments to these levels to the National Assembly Standing Committee based on changes in prices and incomes, allowing for greater flexibility in response to socio-economic conditions.

The law also raises the annual revenue threshold exempt from tax for business households and individuals from VND200 million to VND500 million, and introduces income-based taxation for business households and individuals with higher revenue.

Meanwhile, the Law on Thrift and Wastefulness Prevention, effective from July 1, 2026, establishes a comprehensive and uniform legal framework to prevent wastefulness, promote a culture of thrift across society, and enhance the efficient use of national resources. May 31 is designated as the National Day for Thrift and Wastefulness Prevention.

The Law on Tax Administration introduces the classification of taxpayers into groups, marking a shift from function-based to taxpayer-based management. The law, effective from July 1, 2026, also strengthens international tax cooperation and provides support for business households and individuals in tax declaration based on available data.

Coming into force on January 1, 2026, the Law amending and supplementing some articles of the Law on Value-Added Tax features two articles, aiming to perfect regulations on the VAT policy for farm produce and animal feed, and conditions for VAT refund to tackle bottlenecks and pressing issues, thus facilitating the development of businesses, especially those operating in agriculture.

Meanwhile, the revised Law on Planning clarifies the national planning system, strengthens power decentralisation, simplifies procedures, and resolves inconsistencies between different types of plans. It will take effect on March 1, 2026.

The amended Law on Investment, also effective from March 1, 2026, cuts 39 conditional business lines and revises the scopes of 20 others to better safeguard enterprises' freedom of investment and business. It also prohibits electronic cigarettes and heated tobacco products as in line with a relevant National Assembly resolution.

The Law on National Reserves, effective from July 1, 2026, with provisions on strategic reserves taking effect in 2027, expands objectives to include social welfare, socio-economic development and market stabilisation. It also offers incentives for organisations and enterprises participating in strategic reserves.

Several amended laws, including those on public debt management and statistics, effective from January 1, 2026, further decentralise authority, improve governance efficiency, and enhance the accuracy, transparency and international comparability of statistical data.

Promoting management efficiency and protecting the legitimate interests of businesses and consumers is a key focus of the Law on E-commerce, effective from July 1, 2026. The law introduces regulations on livestream sales and affiliate marketing, requiring platforms to verify identities and handle complaints, while strengthening monitoring of cross-border e-commerce. Foreign e-commerce platforms meeting certain criteria must establish a legal entity or appoint authorised representatives in Vietnam.

Meanwhile, amendments to the Law on Prices and the Law on Insurance Business, effective from January 1, 2026, further decentralise the price stabilisation power, simplify business conditions, and create a more transparent and favourable business environment, ensuring consistency with the broader legal system.