Vietnam expects FTSE Russell to support stock market upgrade

VOV.VN - Prime Minister Pham Minh Chinh has expressed hope FTSE Russell will support Vietnam’s coming upgrade of its stock market from the frontier to emerging market status to attract investment inflows for development goals.

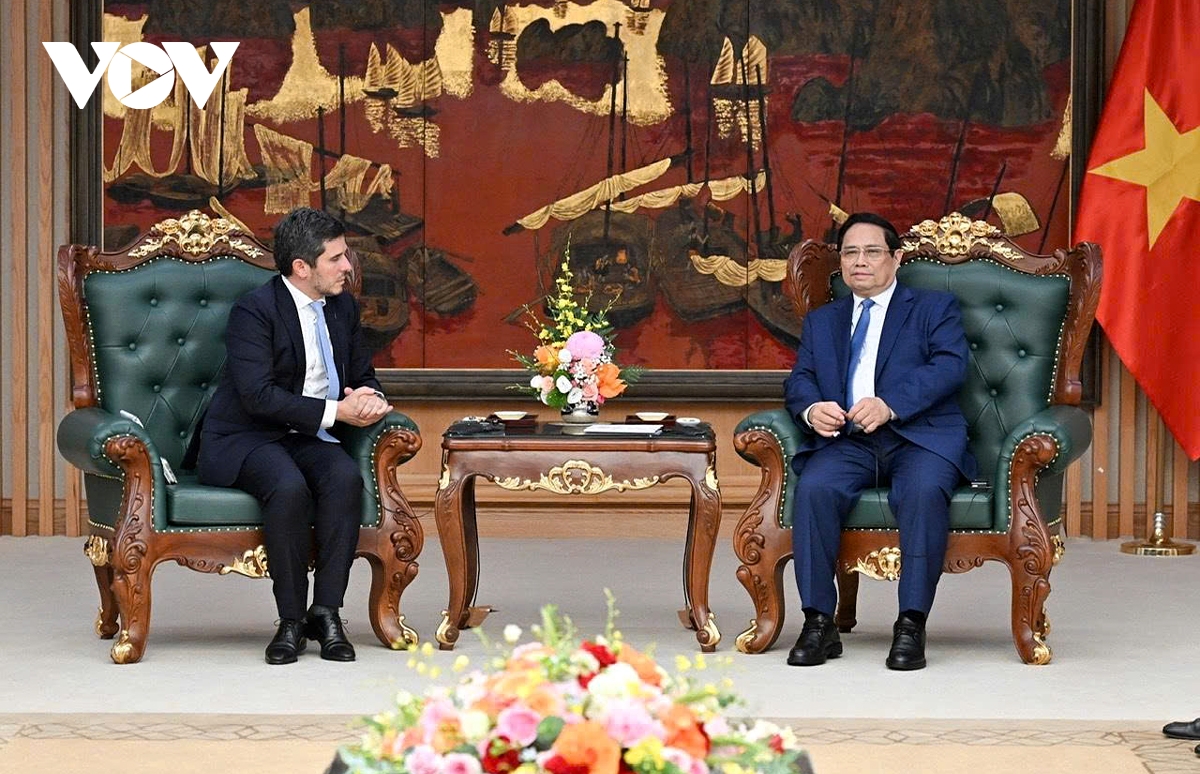

Receiving Gerald Toledano, global head of equity and multi-asset at FTSE Russell, in Hanoi on July 17, PM Chinh shared Vietnam’s development orientations for the coming period, targeting a GDP growth rate of 8% or higher in 2025 and double-digit growth between 2026 and 2030.

To achieve its ambitious growth targets, he said, Vietnam must mobilise significant capital resources, especially by further developing a deep and efficient capital market that can attract both domestic and international private investment. As the stock market is in its infancy, Vietnam is taking a careful and practical approach, by gradually developing it through experience, without rushing or expecting everything to be perfect from the start.

In recent years, he said, Vietnam has demonstrated strong determination to reform its stock market; improve the investment environment to be more open, transparent, and favourable; and commit to protecting the legitimate rights and interests of investors. The Government has submitted the amended Securities Law to the National Assembly and approved a resolution on developing an international financial centre in Vietnam.

The PM proposed that FTSE Russell continue accompanying the Government and relevant state agencies by offering recommendations and advice on practical solutions to help upgrade Vietnam’s stock market to emerging market status. He emphasised the need for the market to develop in a transparent, efficient manner, aligned with international standards, to ensure fast, sustainable, sound, and stable development, and to fully leverage the market as an effective capital mobilisation channel.

He called on FTSE Russell to continue monitoring and providing objective, accurate, and comprehensive assessments that reflect the reality of Vietnam's economy and capital markets. He also urged the organisation to share experiences and provide support in building the legal framework, mechanisms, and policies; developing modern infrastructure; fostering smart governance; and training a professional, skilled workforce.

In addition, he requested support for Vietnam in the process of developing and engaging meaningfully in the operation of an international financial centre, and in attracting capital flows and connecting investors to Vietnam.

For his part, Toledano commended Vietnam's strong commitment, determination, and concrete reforms in socio-economic development, particularly in the financial sector.

He highlighted the country’s significant progress in implementing key structural reforms, including the development of a roadmap for the Central Counterparty Clearing (CCP) mechanism, which he said is a critical step toward meeting international standards and advancing the country’s financial system.

Toledano also recognised the remarkable growth of Vietnam’s stock market, noting especially its impressive liquidity. He affirmed that Vietnam now boasts the most liquid equity market in ASEAN, surpassing both Thailand and Singapore - an important milestone in the country’s path toward an upgraded market classification.

He reaffirmed FTSE Russell’s commitment to supporting Vietnam’s efforts to upgrade its stock market classification from frontier to emerging status.

He also expressed the company’s willingness to accompany Vietnam on its long-term development journey through 2045, contributing to the achievement of key economic goals and improvements in living standards.

Toledano and his colleagues are visiting Vietnam to study the country’s capital market and assess its stock market classification.

FTSE Russell currently evaluates 47 countries and their respective stock markets, covering 90% of global capital markets. The organisation provides indices to 94 out of the world’s top 100 asset management firms, representing nearly US$16 trillion in total assets under management.

FTSE Russell reviews and announces market classification changes every March and September. Vietnam’s stock market has been on the watchlist for an upgrade from the frontier to emerging market status since September 2018.