Positive outlook for consumer spending in Vietnam through 2025–26: BMI

Consumer spending in Vietnam is expected to grow strongly over the next two years, supported by robust economic growth, higher disposable incomes and a solid labour market, according to the latest forecast from BMI, a Fitch Solutions company.

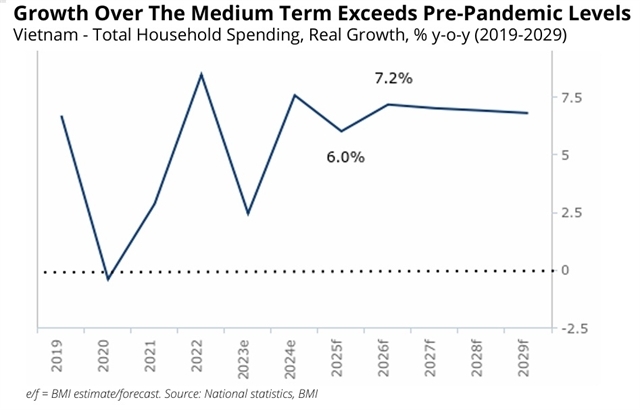

In 2025, household spending is projected to grow by 6% in real terms, reaching nearly VND3.6 quadrillion (US$138.5 billion), significantly higher than the pre-COVID level of VND2.77 quadrillion in 2019.

By 2026, growth will accelerate further to 7.2%, reaching VND3.85 quadrillion.

Stable inflation and a tightening labour market are helping to increase real wages, improving the purchasing power of Vietnamese households.

Retail sales in June 2025 rose by 8.3% year on year, showing the resilience of domestic consumption despite global challenges. Although it was the slowest growth since October 2024, retail sales remain strong by regional standards. To boost domestic demand, the Government plans tax incentives and trade promotion programmes.

Vietnam’s economy is expected to stay supportive, with GDP target of at least 8% in 2025 and double digits in the following years. Inflation should hold at 3.5%, and unemployment at a low 2.1%, supporting wage growth and household spending.

The Vietnamese currency (VND) is also expected to strengthen slightly against the US dollar, making imported goods cheaper and supporting consumer demand.

However, risks persist. High household debt remains a concern, potentially limiting future borrowing and disposable income.

Figures provided by the State Bank of Vietnam indicate that consumer lending in Vietnam has grown tenfold over the past decade. By end-2022, consumer credit reached US$150 billion, or 40% of GDP, much of it tied to housing and small consumer goods. While lower interest rates in 2025 may ease repayment burdens, global rate shifts or a credit slowdown could still affect spending.

Additionally, global risks like trade tensions, supply issues and weaker demand may impact Vietnam’s exports and household spending. A major economy downturn could further dent consumer confidence.

Despite these risks, BMI is confident in Vietnam’s consumer spending potential. Real earnings are forecast to grow by an average of 4.8% through to 2029, pushing purchasing power up by 13% compared to 2019.

With a young, dynamic population and rising incomes, Vietnam’s retail and consumer markets are set to stay among the fastest growing in the region.