FTSE Russell backs Vietnam’s push for transparent capital market

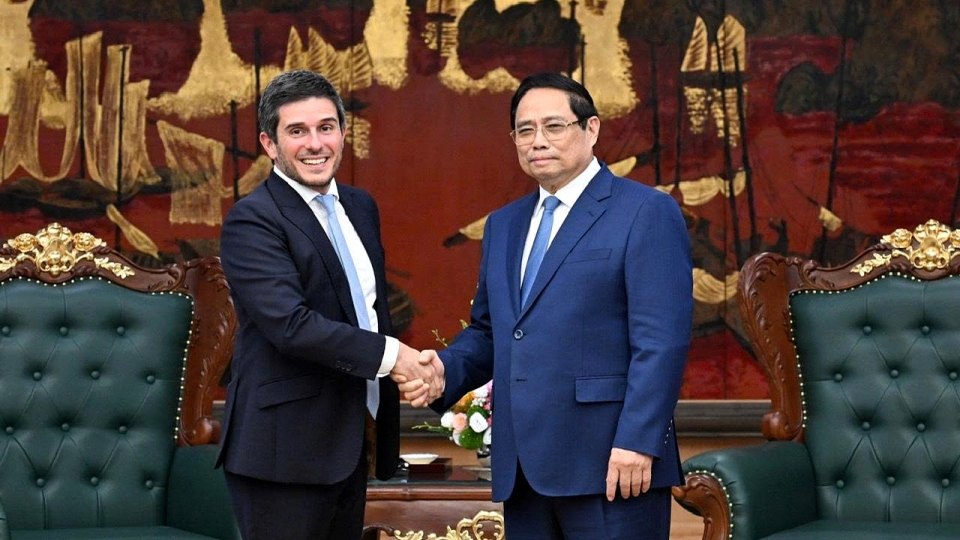

FTSE Russell, a member of the London Stock Exchange Group, stands ready to help Vietnam upgrade its capital market infrastructure to attract stronger inflows of foreign investment, its Global Head of Equity and Multi Asset Gerald Toledano told Minister of Finance Nguyen Van Thang during a working session in Hanoi.

At the working session on July 17, Toledano expressed confidence in a long-term partnership with Vietnam through 2045, when the country aims to emerge as a modern industrialised nation with a transparent, advanced and globally integrated financial market.

Highlighting the growing trend of voluntary pension funds, he reaffirmed FTSE Russell’s commitment to helping the State Bank of Vietnam (SBV) develop indices that help investors better manage financial risks.

In response, Thang outlined Vietnam’s ongoing reforms, noting that the Ministry of Finance has directed the State Securities Commission of Vietnam (SSC) to engage regularly with international market rating agencies and investors to share updates on Vietnam’s stock market reforms and gather feedback.

According to him, the ministry is finalising a draft decree amending Decree No. 155/2020/ND-CP to enhance transparency in foreign ownership limits and eliminate outdated rules, such as those allowing shareholder meetings to set maximum foreign ownership levels. It is also refining the legal framework for securities offerings to improve the quality of listed assets, expand market capitalisation, and boost appeal for both domestic and foreign investors.

He announced that the ministry, now overseeing state ownership in several enterprises previously managed by the Commission for the Management of State Capital at Enterprises, will review their performance and privatisation potential. It will collaborate with ministries, agencies, and localities to accelerate divestment from businesses where state control is no longer needed and streamline the list of sectors with restricted market access. Businesses are encouraged to focus on core operations to increase foreign ownership rates.

To diversify market offerings, the SSC is exploring new financial products aligned with global standards and local demand. Administrative reforms include a draft circular amending regulations to simplify documentation for foreign investors, reduce consular legalisation requirements, and enhance flexibility in customer identification. A new digital platform is expected to streamline document handling, licensing, and market supervision, considerably cutting processing times and boosting transparency.

On the foreign exchange market, the host said the ministry is working with the SBV to develop a legal framework for hedging instruments to address exchange rate risks, a critical need for institutional investors with long-term strategies in Vietnam. The recently launched KRX system has laid the technical groundwork for a central counterparty clearing mechanism, with the Vietnam Securities Depository and Clearing Corporation tasked to draft a roadmap for its launch in early 2027.

Thang welcomed FTSE Russell’s proposal to expand tailored index offerings for Vietnam, pledging full support for deeper collaboration among the SSC, domestic financial market institutions, FTSE Russell, and other global financial organisations.

The ministry strongly encourages training, knowledge transfer and technological partnerships to improve the expertise of Vietnam’s financial and securities professionals, aiming to meet international investor expectations and FTSE Russell’s market classification criteria, he added.