Experts warn of high credit growth risks

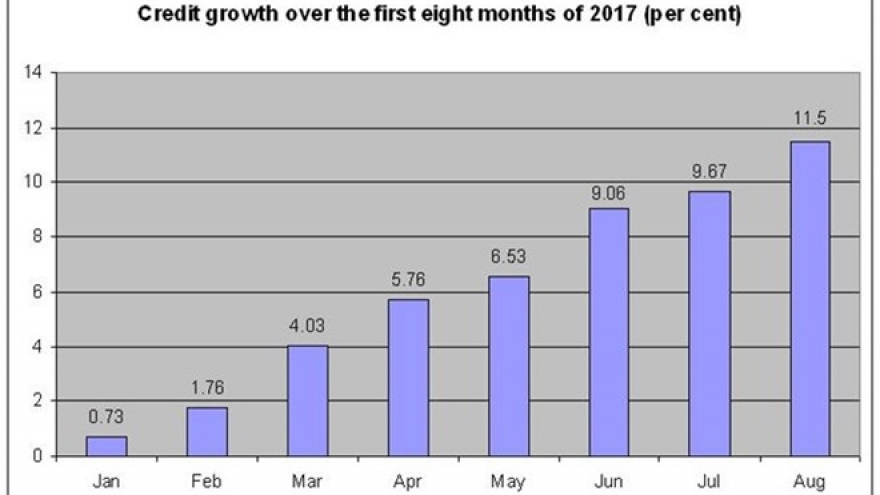

As the Government is striving to obtain credit growth of 20% to 22% this year, many economic experts voiced their concerns over possible adverse impacts of high credit growth on businesses and the economy.

|

| Tran Dinh Thien (R), head of the Vietnam Economics Institute and a member of the Prime Minister’s economic advisory group, speaks at the recent seminar. |

Speaking at a recent seminar organized by HSBC Vietnam Bank, Tran Dinh Thien, head of the Vietnam Economics Institute and a member of the Prime Minister’s economic advisory group, said the Government has raised this year’s credit growth goal from 18% to 20-22%, a record high in five or seven years.

It is not difficult to obtain the target, but the Government should clarify the ultimate goal of the high credit growth, Thien said.Loan growth is supposed to speed up economic development. However, spurring credit up in the final months will not support gross domestic product (GDP) growth this year but in 2018. Meanwhile, next year could require different economic solutions.

In addition, many enterprises are incapable of turning credit into business growth. Currently, the number of Vietnamese firms able to pay corporate income tax accounts for 33%, down sharply against several years ago, and meaning a vast number does not earn a profit.

It is necessary to improve business efficiency first before credit growth could bring about positive results, the expert explained. Besides, high credit growth will place inflationary pressure on the economy.

Credit growth may result in high inflation as seen five years ago, when large volumes of loans were injected into the economy. Therefore, the Government is recommended to maintain credit growth at 18% or below to avoid inflation risks.

Besides, there is a high risk that credit would flow into the property sector. Speculation remains a big issue in Vietnam, so banks may provide huge capital for the stock market and the real estate sector to achieve high credit growth goals, the expert said.

Ngo Dang Khoa, head of trading at HSBC Vietnam, said some VND600 trillion must be injected to the economy in the last four months of 2017 to obtain the credit growth rate of 20-22%.

The nation has seen huge dong liquidity but mostly due to VND160 trillion the State Treasury is keeping at banks. Liquidity will decline as the State Treasury will speed up disbursement from now to the end of this year.

To secure capital sources for reaching high credit growth, banks will have to hike interest rates to mobilize more from the public. Sustainable development in the future cannot be superseded by short-term growth, Khoa said.