Deputy PM pledges to assist firms to expand investment in int’l financial centres

Permanent Deputy Prime Minister Nguyen Hoa Binh on April 28 expressed his hoped that international organisations and financial institutions that have been doing business successfully in Vietnam will be the first members to be present at Vietnam’s first international financial centres and have a foothold in this market.

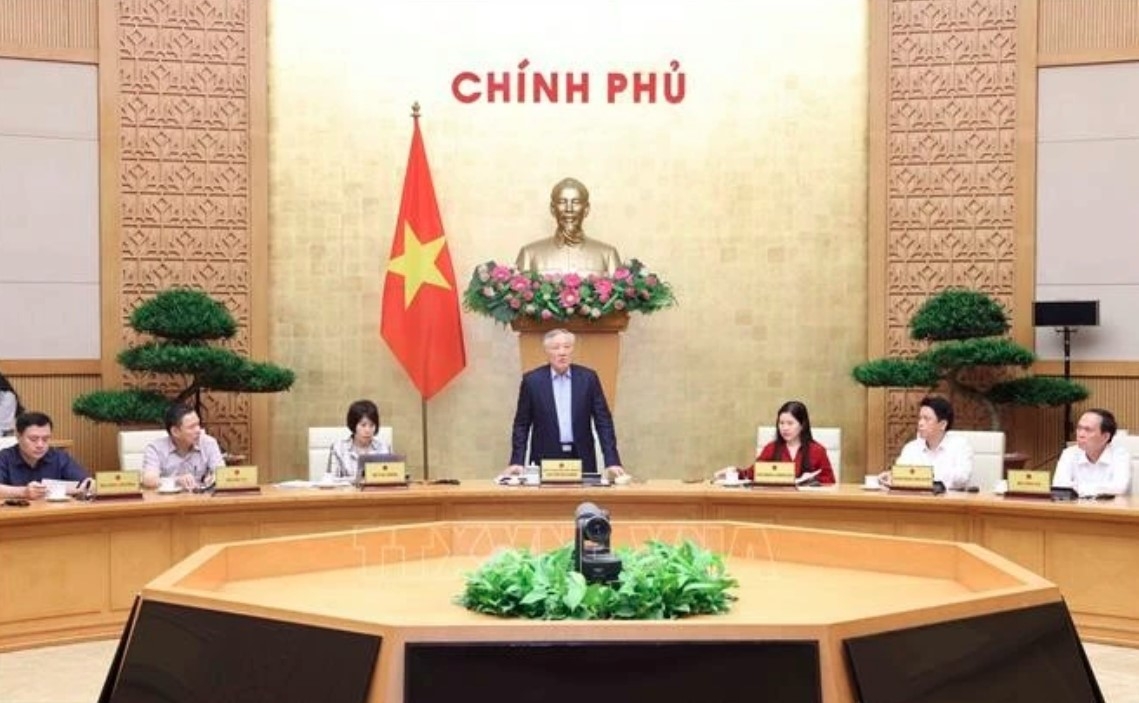

At a meeting with representatives from ministries, agencies, international institutions, banks, investment funds and investors in Hanoi, Binh said that the Government of Vietnam is committed to always accompanying businesses, creating the most favourable conditions for enterprises to expand their investment in international financial centres in Vietnam as well as invest in other ecosystems that they are interested in.

Discussing the National Assembly (NA)'s draft resolution on the establishment of international financial centres in Vietnam, many participants said that it has made great strides, in line with international practices and standards on the construction, operation and development of a modern international financial centre.

According to a representative of Temasek investment fund, the draft resolution has approached international practices. This is an important legal framework for the process of forming, operating and developing an international financial centres in Vietnam according to international standards and practices with outstanding and breakthrough policies, a separate arbitration mechanism, attractive tariff incentives, and modern asset management.

The draft needs to continue to supplement stricter regulations on the issue of information security of organisational and individual investors as well as regulations on the settlement of international disputes at the financial centres.

Meanwhile, representatives of banks such as Standard Chartered, ADB, HSBC, SSI Fund, and the Japan International Cooperation Agency (JICA) hoped that the draft resolution will clarify the regulations on preventing money laundering, the application of laws in international financial centres in the correlation between Vietnamese laws and foreign laws according to international practices.

More flexible regulations are needed on the registration, recognition and termination of membership; the organisation of activities of international arbitrators in handling and resolving international disputes; mechanisms to promote and call for investment, risk management, especially risks related to the market, insurance, commodity derivatives, and information, they suggested.

According to Binh, the draft resolution is expected to be passed in the NA's meeting in May, providing a legal framework for the establishment and development of international financial centres in Vietnam.