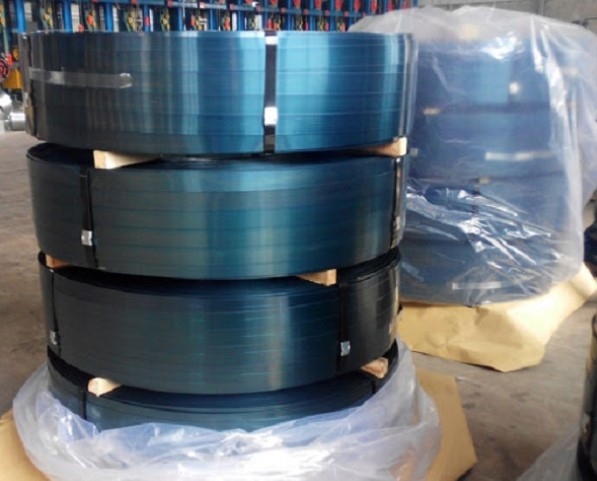

Canada finds no dumping in Vietnam’s steel strapping

VOV.VN - The Canada Border Services Agency (CBSA) has concluded that the only Vietnamese company currently exporting steel strapping to Canada did not engage in dumping.

The Trade Remedies Authority of Vietnam (TRAV) under the Ministry of Industry and Trade said on December 16 that the CBSA issued its final determination on Dec. 15 in an anti-dumping investigation into steel strapping imports from several countries, including Vietnam.

For the only Vietnamese enterprise currently exporting the product to Canada and cooperating in the case, the CBSA found no dumping and therefore imposed no anti-dumping duty. For other Vietnamese exporters, however, a duty rate of 25.3% was applied based on facts available.

The CBSA also concluded that steel strapping from exporters and countries elsewhere continued to be dumped, with anti-dumping duties reaching up to 47.9%. In addition, products originating in China were found to be subsidized, with a countervailing duty set at CNY 0.44 per kilogram.

The case is now under review by the Canadian International Trade Tribunal (CITT), which is assessing injury to the domestic industry. A ruling is expected before Jan. 14, 2026. Further details will be provided in the Statement of Reasons, scheduled for release within 15 days.

The investigation was launched in May 2025 following a complaint filed by JEM Strapping Systems Inc. The dumping investigation period covered April 1, 2024 to March 31, 2025.

According to data from Trademap, Vietnam’s steel strapping exports totaled US$7.8 million in 2022 and US$4.3 million in 2023.

Earlier, the CBSA issued a final determination in a separate anti-dumping case involving carbon steel wire and alloy steel wire imports from several markets, including Vietnam. In that case, the dumping margin for a major Vietnamese enterprise was set at 5.7%, down sharply from 13.4% in the preliminary determination, while other exporters were assigned a margin of 158.9% based on adverse facts available.

The dumping margin applied to the cooperating Vietnamese exporter was the lowest among cooperating firms from other countries and territories, whose margins ranged from 9.4% to 58.1%.

In all trade remedy investigations initiated by foreign authorities against Vietnamese exports, the TRAV continues to urge manufacturers and exporters to fully cooperate with investigating agencies, provide complete information and data when requested, proactively review products subject to investigation, and closely monitor official notices. Past cases show that full cooperation has helped many firms avoid duties or secure lower rates.