Vietnam’s PMI sees slight fall amid rise in new export orders: S&P Global

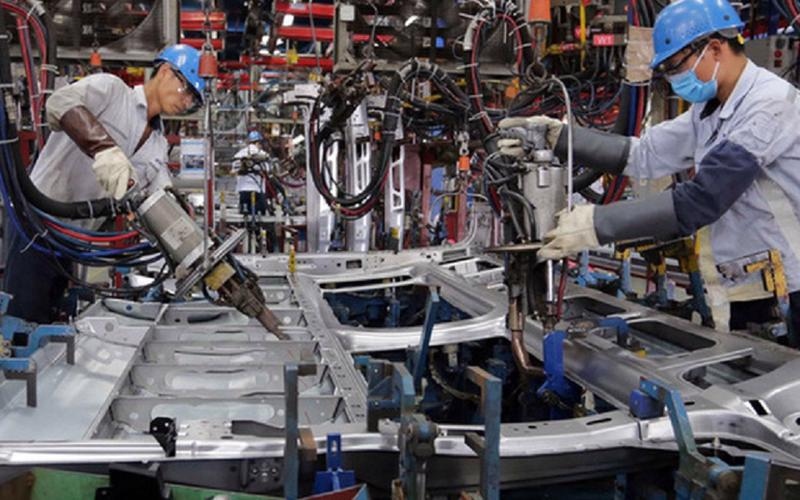

VOV.VN - After recording an improvement in August, overall business conditions in the Vietnamese manufacturing sector marginally declined in September amid sustained growth of new orders, according to the latest S&P Global Vietnam Manufacturing Purchasing Managers' Index (PMI).

Specifically, the PMI posted 49.7 in September following a reading of 50.5 in August. The index signaled a deterioration in business conditions for local manufacturers, albeit one that was only marginal.

Underlying data pointed to a strengthening demand environment coupled with growing business confidence, but also a degree of spare capacity in the sector which has led to reductions in output and employment.

Furthermore, rates of inflation gathered pace, with both input costs and output prices rising more quickly at the end of the third quarter.

The most positive aspect of the latest survey was a second successive monthly increase in new orders, with the rate of expansion coming broadly in line with that seen in the previous survey period.

A number of respondents signalled that strength in new export orders, particularly from other Asian economies, has helped to boost total new business.

The rate of expansion in new sales from abroad was also at a solid level and was even more pronounced than that seen in August.

Despite the continued pick-up in demand, manufacturers signalled that fresh order receipts remained relatively modest, leading to an overall scaling back of production. Output was down slightly following the rise recorded in August, with production now having fallen in six of the past seven months.

“The picture was mixed in the Vietnamese manufacturing sector during September. On a positive note, firms continued to see demand pick up, with a particularly encouraging rise in new orders signalled. This fed through to greater confidence in the year-ahead outlook,” said Andrew Harker, economics director at S&P Global Market Intelligence.

“On the other hand, there is clearly still some excess capacity in the sector, which meant that firms continued to lower employment and also scaled back output slightly, opting to use the inventories that had been building up in recent months to help meet new orders,” he added.

“The sector is therefore at something of a crossroads. Should demand continue to pick up, this should feed through to growth across the sector. If the recovery in new orders loses steam, however, firms will remain reluctant to expand capacity too quickly," he concluded.