National foreign reserves on the rise despite unfavourable factors

VOV.VN - Vietnamese foreign exchange reserves have increased considerably over recent years and are expected to remain on an upward trajectory moving forward despite unfavourable factors, according to international financiers the World Bank (WB) and the International Monetary Fund (IMF).

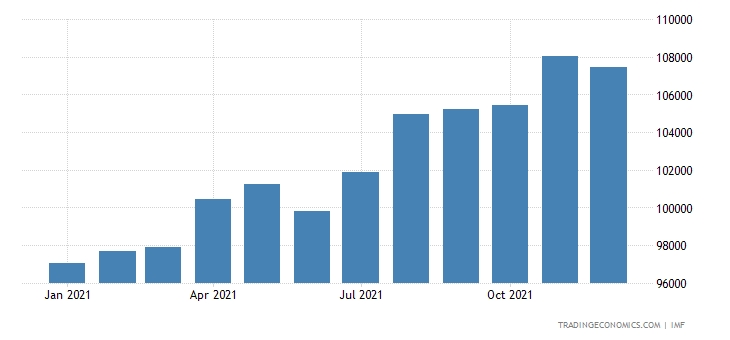

Sources from the WB and the IMF indicate that the country’s foreign exchange reserves have consistently been rising each year, climbing from US$12.5 billion in 2010 to US$25.3 billion in 2015, before reaching US$55.5 billion in 2018 and US$105 billion in 2021.

International financiers attributed these high reserves to Vietnamese efforts to attract foreign direct investment capital, produce a trade surplus, and to stabilise the US$/VND exchange rate. The exchange rate has even fallen slightly over the past two years, prompting the State Bank of Vietnam to purchase foreign currencies aimed at increasing national reserves.

It is expected that foreign exchange reserves will continue to rise in the coming time, particularly as the State Bank is making use of favourable factors to raise the reserves level.

The country is likely to produce a trade surplus for the seventh consecutive year year in 2022, with US$5 billion to US$7 billion expected. Meanwhile, Remittances by overseas Vietnamese have increased by 4.4% annually over the past three years and are poised to hit US$18.9 billion this year.

However, rising commodity prices are starting to bear pressure on inflation which is projected to exceed the 4% target set for this year. In addition, the US dollar (US$) is likely to appreciate in value as it has fluctuated globally on the back of the ongoing armed conflict between Russia and Ukraine, coupled with economic sanctions imposed on Russia by Western allies.

Despite facing this array of challenges, Nguyen Tri Hieu, a banking and finance expert, affirms that the country still maintains a positive position with foreign exchange reserves.

“Once foreign exchange reserves are abundant, the State Bank will have plenty of room to effectively manage financial and monetary policy in a way to stabilise the exchange rate and improve the value of the VND,” analyses Hieu.

Furthermore, he says high foreign exchange reserves will greatly contribute to the domestic economy’s ability to resist external shocks, thereby contributing to stabilising the macroeconomy and strengthening foreign investors’ confidence.

“The exchange rate policy is always an important macro factor for foreign investors to consider if they intend to invest in Vietnam,” concludes Hieu.